FAQs for Pillar 3 in Switzerland

No more delays in setting up your Pillar 3 – all questions and answers.

😒 “Whatever, I’ll look into it some other time!”

… you say. Somebody told you about Pillar 3 (“third pillar” / “dritte säule”), and half an hour surfing the web only left you with more questions.

Maybe this is not even the first try. And like last time, you won’t pull the trigger. It’s good that you don’t decide without clarity. Yet, one more year will cost you tens or hundreds of thousands of CHF.

So if that sounds familiar, this post is for you. It addresses 90% of the questions that typically come up when looking at Pillar 3 – simply and with practical outcomes.

You may know some answers already. If you know all, check out my tips for the best digital Pillar 3 products in Switzerland instead.

The TL;DR version

Use this content as reference material to complement your knowledge on Pillar 3. If you want get started and done with your Pillar 3 quickly, a top-to-bottom read is worth your time.

Here’s the summary of what’s explained below:

- Pillar 3 is an easy tool to save tax money and grow savings faster than with pension.

- It’s worth to do if your yearly gross salary is > 60'000 CHF/year.

- It takes about half a day to set up, and earns you 2-3 times the money you put into it.

- Go for bank-based and avoid insurance-based Pillar 3 products, that bind you unnecessarily.

- If you are young, go for funds with strong equity components; if you are close to retirement, don’t.

And here’s how your customer journey will look like:

| Step | Decision | Time |

|---|---|---|

| 1 | Decide whether Pillar 3 makes sense for you altogether. | 10' |

| 2 | Decide whether you go for bank- or insurance-based Pillar 3 products. | 10' |

| 3 | Decide what account vs securities allocation you want your Pillar 3 product to use. | 10' |

| 4 | Pick your Pillar 3 product and start it. | 2-4h |

| 5 | Optionally optimize your setup. | 1h |

Behind this article

Half the swiss population does not use Pillar 3, despite its prospect to substantially improve quality of life. Pillar 3 is a boring topic so it’s no surprise people prefer to go for a hike instead 😂

This post aims at making it simple and quick for people to understand Pillar 3, and decide if and how it suits them. It collects all key choices and addresses the frequent doubts and concerns by using data.

This article is twin with my review of the best digital, sustainable Pillar 3 products, which aims at simplifying getting started if you’ve decided to do so.

If you wish to inspect methodology or reproduce results, download the Research Package, which includes all data sources at the time of analysis.

I have no affiliation with any vendor.

Research, writing, and review process of this content took ~45 hours.

Disclaimer: All information on this page is my opinon and for information purposes only. It is not intended as financial advice. Do your own research or seek professional financial advice before taking financial decisions.

What is Pillar 3?

Pillar 3 in Switzerland are funds where you lock your money until retirement, in exchange for tax benefits. It’s a way for the Swiss government to encourage people to save money, which improves the country’s economy and social tissue in a number of ways.

It’s called “Pillar 3” because it builds onto 2 other pillars. These other 2 pillar are taken care for you – so you don’t need to read much about them.

You may hear other names for Pillar 3 – and they mean exactly the same:

- Third pillar 🇬🇧

- Dritte Säule 🇩🇪

- Troisième pilier 🇫🇷

- Terzo pilastro 🇮🇹

Why should I care?

What makes Pillar 3 worth understanding, instead? It’s interesting for 2 reasons:

- It saves you taxes. In a lot of cases, it saves you 2'000 CHF/year or more depending on salary and residency.

- It grows your money through a very long-term investment. Start 30 years old with a good Pillar 3, and in normal circumstances you’ll be a Millionaire by the time you retire! Assumptions: residency in Zurich, in-payment of 7'000 CHF/year each year, salary ~120'000 CHF/year, equity-based fund with equities performing the average they did the last 50 years, no other substantial tax deductions.

A caveat: You’ll hear Pillar 3A and Pillar 3B:

- Pillar 3A

- Or just “Pillar 3” in this article; has substantial tax savings. That’s what this post covers.

- Pillar 3B

- Has insignificant tax savings. See details on the pillar 1, 2, 3 if you care about the details, but it’s not interesting for this article.

How ethical is it?

There are 3 parts to this answer – let’s look at each individually.

Tax savings

How ethical is it to use Pillar 3 to save on tax?

It’s highly ethical. The Swiss government incentivizes citizens to use Pillar 3 by providing tax rebates. They do so to improve social security: citizens who continually save some money have lower chances to become a burden to society in old age.

Investing in equity funds

You’re likely to use equity funds for your Pillar 3 (more on this later), so how ethical is it to grow your Pillar 3 with equity funds?

This is ethical as long as you ensure that your money is not invested into harmful companies. To do so, demand sustainable funds – which ensure that your money is not used to back companies with a poor track record.

Don’t know how to require sustainable funds? Check out my article on the best digital Pillar 3 products for an actionable shortlist and more explanation.

Investing overall

Finally, how ethical is it to have your Pillar 3 grow money out of bare money?

This is a more fundamental question, up to your own judgement.

Overall, this is a reward for the sacrifice you make for not availing of this money for a while. Others can do something with this money which will make them earn more money. A farmer can use your 20'000 CHF to buy a tractor to work twice the land size, and create 30'000 CHF worth of extra produce in the following years.

Investing that money is putting it at the service of others who can create more value for society out of it. For that, you’re rewarded. Just make sure you screen who’s allowed to make use of your money, with the sustainability comments above.

You’re welcome to share your own judgement in the comments below.

Why does Pillar 3 save you money?

Because the Swiss government lowers your tax when you pay into such funds. They do so to encourage people to save money today, so they won’t be a burden to welfare when they become old or unable to work.

Here’s the overall structure:

- You save money every year in tax savings. As a rule of thumb, paying into Pillar 3 saves you 1-2% of your yearly gross salary. That’s some 2'000 CHF/year for a lot of people.

- You pay some extra tax when you retire and withdraw your Pillar 3 fund. As a rule of thumb, that’s some 5-20% of the overall amount.

Let’s look at each part.

Withdrawal tax

You save tax now, but pay tax later. This is what discouraged me from opening my Pillar 3 when I first looked at it several years ago.

On top of that, many sales agents of Pillar 3 products won’t tell you about this, and don’t know the numbers if you ask.

The deal is still worth it plenty, because:

- The yearly saving is multiplied by the number of years you contributed.

- The lump-sum payment at retirement can be often optimized to reduce that amount to ~5%.

If you set yourself up right, here’s a ballpark figure for example:

- You save 45% = 1.5% a year * 30 years.

- Paying pay 5% on the final amount.

Quantify your saving

Let’s make an example on how to compute your savings:

- Take your gross salary. For example ⇒ 100'000 CHF.

- Take out 15% (deductions from Pillar 1+2 at 30 years old) to obtain the Net salary. ⇒ 85'000 CHF

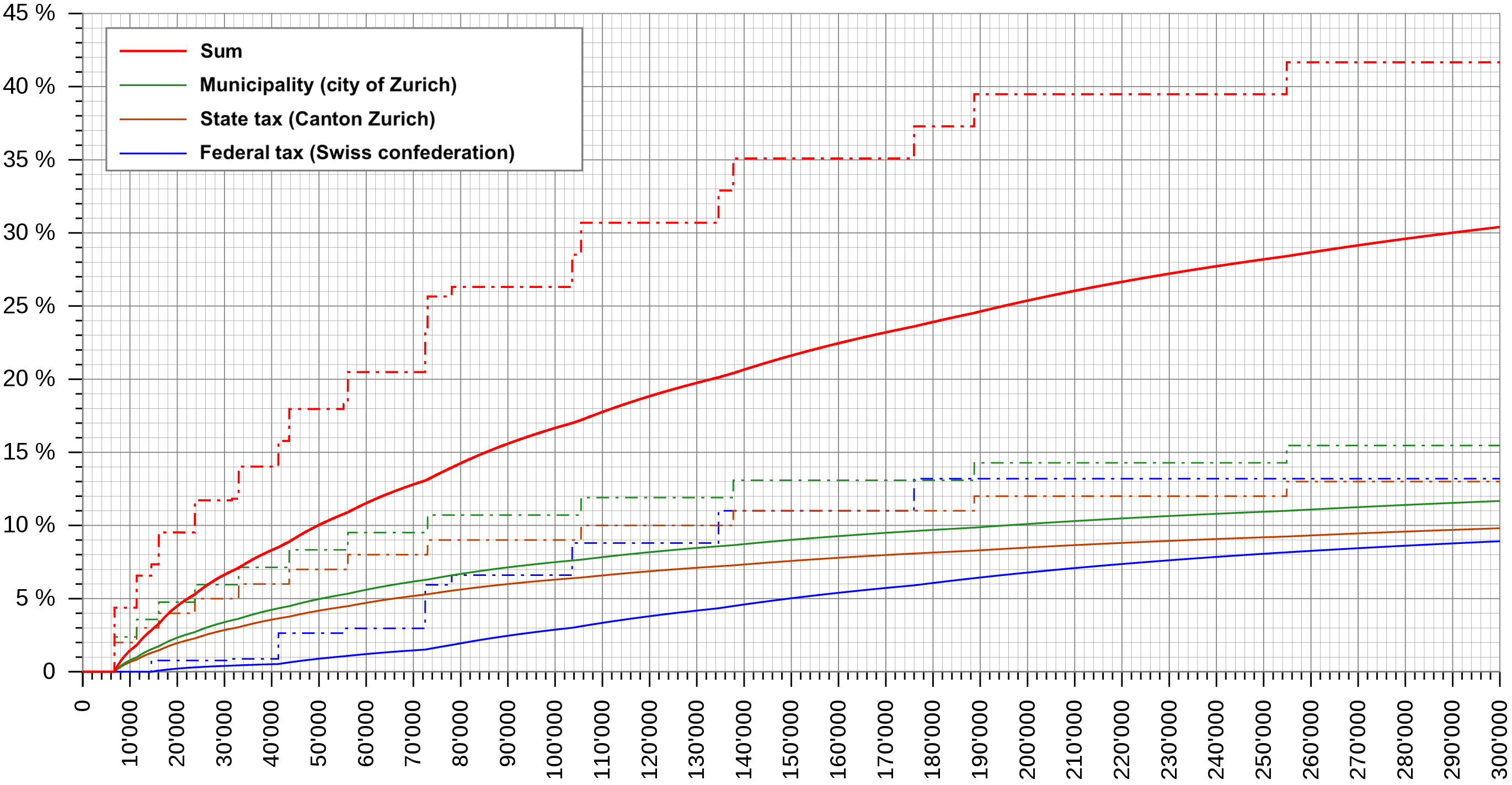

- Look up Net Salary in your municipality’s tax rate to find the marginal tax rate. In the figure below with tax rates for Zurich (credit Wikipedia) , the marginal rate is the dotted line on top ⇒ 26%.

- Your tax saving is 26% of 7'000 CHF ⇒ 1'820 CHF.

There you go, you save 1'820 CHF a year.

If your salary grows over time, and becomes 135'000 CHF/year, then your Net salary ≅ 115'000 CHF, marginal tax rate 31% ⇒ you save 2'170 CHF a year. Repeat 30 years until retirement, and you saved over 60'000 CHF.

Marginal tax rate

The marginal tax rate is what causes these big savings.

Make sure to check the marginal tax rate (dotted line, 26% at 85'000 CHF), and not the total tax rate (solid line, 15% at 85'000 CHF)!

The marginal tax rate is the maximum rate you pay on the “last amount” of your income. This rate raises in big steps as your income increases, due to tax progression, through which the state makes the “rich” pay increasingly higher tax.

Tax rates by net income in Zurich.

Combining saved and withdrawal tax

So far we looked at what you saved. Now to the second part of the story.

When you retire and get your money out of your Pillar 3, that payout will be taxed, too – which chips away a part of your tax savings.

That’s less than what you saved – because the payout is taxed as capital gain, rather than income. For Zurich, starting 2022 this amount is around 10% for amounts between 500'000 CHF and 1'000'000 CHF. That’s assuming you don’t opt for any optimizations.

Let’s compare the saving:

- You deposited 210'000 CHF over your lifetime.

- This saved you 60'000 CHF in tax.

Even if your investment did not grow at all (0% growth), you’d take out your 210'000 CHF with only 6% tax = 12'600 CHF. So you saved 60'000 and paid 12'600.

Real Pillar 3 products do grow your money, though. Thanks to that, you’ll be happy to withdraw more money. Total tax will always grow slower than the capital. You can play around with the amazing tax calculator for payout of Pillar 3 of the swiss confederation 🇨🇭 to see what rates apply.

Finally, you can actually do better than the rates above, and organize your Pillar 3 so that you pay half of the withdrawal tax – again in a perfectly legal way. See optimization tips for details.

How much money does Pillar 3 generate?

This depends mostly on how long you run your Pillar 3, and what type it is.

As a rule of thumb, you can expect to get out 3 times (300%) what you put in – assuming you pay in 25 years and use the setup I describe below.

As I write this I realize that number is so big, it may sound like one of those “get rich quick” schemes 🤣 so let’s elaborate on why that is.

First, it’s not “quick”. The whole thing works best because long times are involved.

Second, check out the graph below showing this growth. You notice that most of the growth occurs in the later years. Assumptions for this graph: you work until retirement, average gross salary across your career 135'000 CHF/year, residence in Zurich, Pillar 3 with 100% equity, annual net returns of 6%.

The lines in this graph show:

- Invested

- The money that you put into your Pillar 3, less the tax you saved, over the years.

- Accrued

- The money that will be paid out to you when you retire and close the fund.

Now scroll your finger on the graph and check the years #46 and #47, for example: That’s a growth of 110'000 CHF in one year! 😮 Now, that’s possible if you start your Pillar 3 at age 18 and work all the way to retirement at 65, but you get the key lesson:

That really is the key lesson here. I wish somebody told me while I was young 💩! But hey, here’s why I tell you, now 😉

This Compound Effect is extremely powerful, and one of the key reasons why Warren Buffet is so rich without bringing any special innovation into society: He started in his teens and continued into his 90s – by when he’s Billionaire. In the last 10 years, he built twice as much wealth as he built in the prior 45 years combined.

Compound effect

The compound effect is the cause of the exponential growth you see in the graph above.

With this effect, a fixed growth rate (e.g. interest rate) applied many times over, creates increasingly higher returns.

Let’s use the diagram below to understand this graphically:

- Scenario: you pay into a fund which returns you a fixed 6% interest.

- At the beginning of Year 1 you deposit 100 CHF – that’s your “principal”.

- At the end of Year 1, you gained 6 CHF from the 6% interest.

- At the beginning of Year 2, your capital is 106 CHF.

- At the end of Year 2, you gained 6.36 CHF – 6% of 106 CHF.

- … and so on. By Year 10, your Principal is 169 CHF; the 6% interest is 10.14 CHF.

Notice the different amounts returned by the same 6% interest over the years. The essence: More principal causes higher interest returns, which cause more principal – in an avalanche effect.

When is Pillar 3 worth doing?

Pillar 3 is worth doing if all of the following apply:

- You already have a safety buffer ≥ 25'000 CHF.

- You have disposable income > 10'000 CHF/year.

- You don’t need those savings until retirement.

- Your salary is > 60'000 CHF.

Let’s look at them individually.

Safety buffer

A safety buffer is money you need for any emergency which may arise: Medical expenses for yourself, dependants or darlings, material accidents, fines etc.

This may be money sitting in your bank account, or available in different forms – e.g. by borrowing from your parents or relatives, or by selling something of value. In any case, it needs to be money available surely, quickly and unconditionally.

A safety buffer is important, and you need to define how large yours should be. If you miss this buffer, a small surprise in life can quickly degenerate into an aweful situation.

Disposable income

Disposable income is money left at the end of the month, after you got your paycheck and paid all your expenses.

If you can save > 10'000 CHF/year, Pillar 3 is worth doing. If not, you’re unlikely to be able to put a substantial part of your disposable income into social security. If your salary is low, work towards increasing it. If you spend a lot, look into which of your expenses are necessary and which don’t improve your life much.

Having a small disposable income becomes a larger obstacle if you plan a large spending before retirement – anything beyond the emergency fund. You may strive to buy an expensive car or a holiday home in Spain.

You can take money our of your Pillar 3 only for:

- Buying a house in Switzerland.

- Starting your own business.

- Leaving Switzerland to move abroad.

In all other cases, your money is locked until retirement or disability.

Salary

Finally, if you earn < 60'000 CHF/year, your net salary has such low taxation that Pillar 3 only gives you negligible tax benefits.

In this case, any other investment will be materially comparable, and not constrain your money for decades. Unless you sit on a large bank account, having that money available is probably more valuable to you than saving 20 CHF/month.

How to get Pillar 3 started?

The process is simple, and it takes ~4h for a well-informed choice:

- You select your Pillar 3 product. Account 2h for a well-informed choice; don’t rush it. See my review to speed this up.

- You open an account with them. Account 1h for this. They’ll ask you some standard questions to build your risk profile, answer them accurately and honestly, in your own interest.

- Every year, you find the maximum tax-deductible amount (google for “switzerland Pillar 3 2021”, or whichever year it is). 30 seconds or less.

- You wire that amount into the IBAN of your Pillar 3. 5 minutes or less.

Done. If you start young and stick with this, you have good chances to retire a millionaire.

If you do start young, make sure to optimize this setup as well, as it’ll make a big difference by the time you retire.

The essential choices

| Choice | Recommendation | Background |

|---|---|---|

| Pillar 3 from a bank or insurance? | Bank, preferably digital. | See Banks vs Insurances. |

| Which Pillar 3 product should I get? | Viac, Finpension or Descartes. | See my review. |

| What part of account vs securities? | Maximize securities until 15y from retirement, then grow account. | See Interests vs securities. |

| What can I do to optimize my Pillar 3? | Create 3-5 accounts over the decades. | See optimization tips. |

In the remainder of this post, you find clarifications and advices on the most frequent questions you’ll be faced with when setting up your Pillar 3.

Banks vs Insurances

There are 2 main types of Pillar 3 products:

- Bank-based Pillar 3

- Insurance-based Pillar 3

My recommendation is to go for a bank-based product, because they don’t bind you for life, because the benefits you get from insurance are overly expensive, and because insurances still lack digital offerings. Here’s the key facts for your comparison:

| Bank | Insurance | |

|---|---|---|

| Flexibility | 👍 Pay as much/little as you want. | 👎 Pay a minimum amount every year until retirement. |

| Change vendor | 👍 Yes, any time and no strings attached. | 👎 Yes, but only at a substantial cost (saved assets and sale fee). |

| Performance | Comparable with market. | Comparable with market, although higher cost typically reduce it. |

| Disability | Your account continues growing only passively. | 👍 They pay up your future instalments into your fund until retirement. |

| Strategy | Can choose your mix of interests vs securities. | Can choose your mix of interests vs securities. |

For a full comparison, see differences between bank and insurance Pillar 3s.

A couple of highlights here:

- Both banks and insurances allow you to choose how your money is kept, in accounts with interests or invested.

- Does protection against Disability & death attract you? Before you pull the trigger, do some research: insurance-based Pillar 3 may cost you more than a separate life insurance.

Interests vs securities

Pillar 3 products allow you to choose how they should use your money:

- Accounts: They put it into a bank account which pays you the traditional interest rate.

- Securities: They invest it for you – typically in the stock market.

When you create your Pillar 3, they’ll let you choose your mix: for example, they’ll have options with “20% account, 80% securities” or “40% account, 60% securities” etc.

The reason to maximize securities is opportunity cost: if you don’t, you lose (fail to earn) money. Let’s look at these options in detail.

Accounts lose you money

When you choose an Account allocation (e.g. “20%”) – you’re asking your Pillar 3 to put that part of money in a bank, and (maybe) get some interest out of it.

This was a reasonable option in the past, especially among the most conservative people. It’s no longer an option today: interest rates have been ~0% or negative since the 2008 crisis, i.e. for over a decade, with no change in sight.1

What this means is: your money never grows. You actually lose money for 2 reasons:

- Fees – operating costs associated with your fund. See my explanation on TER in my Pillar 3 review post

- Inflation. Check out the evolution of prices (CPI) in Switzerland in the figure below2. Buying one product in 1991 for about 80 CHF would cost you 100 CHF in 2021. 30 years later, prices are 30% higher!

In the past, banks offered Pillar 3 revolving around accounts with interests, and insurance companies offered Pillar 3 with strong securities components. Today, they are only distinguishable for other features.

Securities make you money

Let’s now look at securities, which means that your money is dominantly invested in the stock market – i.e. buying small pieces of a lot of companies.

Two are the common doubts on the stock market:

- Safety: Is my money safe? Is it not a little bit of a gamble?

- Complexity: There’s so much to learn, and I don’t really care!

Let’s look at safety first.

The stock market in its rawest form does carry some risk. However, compare that with an account, which essentially guarantees that you lose buying power.

Additionally, the stock market is much safer once you use two practices:

- Diversification – i.e. buying into a fund as opposed to individual stocks. The fund invests in many companies, so that one dipping is compensated by another growing. Betting on such fund is a bit like betting on the growth of the broader economy.

- Time – the stock market “corrects” every some years – rapidly losing value – but “rallies” just as rapidly thereafter, rapidly gaining value. If your time horizon is decades, that attenuates much of those ping-pongs.

Touch this with your own hands. Check out the graph below3 with the value of S&P 500 – which collects pieces of the 500 biggest companies in the US. I pick this index purely because it’s the only major index whose data goes back 100 years. Other indices, like SPI in Switzerland, have very similar features.

Now, in a Pillar 3, you’re going to invest for 25-30 years. So span 30 years with your fingers on the graph, and slide them along the past century to seek times where you would buy at a higher price than you sold for. Use the solid line for that.

Finding any time where you’d have lost money is very difficult, uh? You need to go all the way back to the peak right before the devastating Great Depression of 1929.

And it gets even better! The standard S&P 500 graph (solid line) only shows you the price of S&P500. That’s only a part of the story! When you buy S&P500 stocks, you also earn dividends from the profits that the underlying companies generate. You gain dividends continually throughout the year, and they typically get re-invested into your fund. You should account for those continual earnings as well.

So in the graph I also show you the Total Returns, i.e. the price combined with the dividends (the dotted line). That is the real test you need to make.4

Repeat your test with the dotted line (Total Returns) – seeking a 30-year long time period where it lost you or gained you no money. Good luck with that 😉

Crunching some numbers from the S&P 500 graph above: (see research package to reproduce)

- It never happened, over the last century, that you’d lose money if you invested in the US stock market for a period > 20 years – when accounting for dividends.

- It never happened, over the last century, that you’d get < 2.8% annualized returns, if you invested > 25 years – when accounting for dividends.

So here’s the conclusion:

To close the safety part: Past performance is no guarantee of the future. The Japanese market showed us that clearly, and is the only western market in history to have done so. However, keep in mind that apparently “safe” investments like bank accounts or treasury bonds actually lose you buying power through fees and inflation, and that dividends completely change the game when looking at the returns of the stock market.

Secondly, and finally, let’s look at complexity. Do you need to know stuff to use a Pillar 3 invested in securities?

Not much. You only need to opt to invest in securities, and they’ll simply do so. They use funds already to smoothen out returns, they choose their funds for you, and you don’t need to know the details. Those funds will collect your dividends and reinvest them into the fund, so you benefit of some more compounding.

Simply demand that your Pillar 3 vendor use sustainable funds, so your money won’t be used to back harmful companies. Check out my review of digital Pillar 3 products for 2021 if you need ideas for that.

Choices for account vs securities

Here’s what the observations above suggest we do when setting up a Pillar 3:

- Fixed interest accounts are no longer a reasonable option. They dissipate you money through fees and inflation.

- Choose the largest allocation of equity available in your Pillar 3 to maximize returns – if you’re > 15 years away from retirement.

- If you’re risk adverse, use the last 15 years before retirement to progressively move your securities part towards an account, e.g. 10% each year. You’ll lose growth in return of more stability.

How do I switch Pillar 3 vendor?

You may have a Pillar 3 account already, but have meanwhile identified a product which you like better.

Here’s how you relocate from one to the other.

Switching from bank pillar 3

If your current account is a bank-based Pillar 3, life is smiling at you 😄

- You can switch.

- You can do so whenever you want, no questions asked.

- It will cost you nothing.

- You can do so regardless how young or big your current account is.

Here’s the overall process (bank-based):

- Create new account: You create the new account at your selected vendor.

- Fill out transfer form: Get the transfer form from the new vendor, which collects the recipient bank coordinates and your signature for authorization. Find this typically in your new user account (or app), if your new provider is digital.

- Send transfer form to old vendor: Look up email, fax, or snail mail to send your signed transfer form to the old vendor.

- Wait and see: The current provider will transfer your fund to the new provider, and then close the account.

Switching from insurance pillar 3

If, instead, your current account is an insurance-based Pillar 3, you’re out of luck:

- You can switch.

- It will cost you bitterly. In many cases, you won’t even get back all the money you paid in, let alone its growth over the years.

Here’s the overall process (insurance-based):

- Inform: Consult the current vendor and get all the costs and penalties associated with dropping them.

- Ponder: Consider if it’s worth dropping them, based on the future prospects. If you’re unsure, consult the new vendor, or a financial advisor.

- Execute: If you do decide to execute, the process is similar to the process described above for bank-based Pillar 3.

How to optimize Pillar 3

Starting a Pillar 3 gets you 90% there. Once that’s done, pat yourself on the back and relax.

Over the years, with calm, there are a couple of things you can do to improve your final outcomes. These take you 90% to 100%:

- Create multiple Pillar 3 accounts over the years – to avoid being unfairly destroyed with tax at retirement.

- Monitor your Pillar 3 options every few years – to ensure you get the most out of your savings.

- Tweak allocations while approaching retirement – progressively moving from volatile securities to stable account.

Multiple Pillar 3 accounts

Why open multiple Pillar 3 accounts? Let’s compare scenarios.

In the base scenario you use one Pillar 3 only. When you retire, the Pillar 3 account is automatically closed and paid out to you at once – potentially over 1 Million CHF. One huge lump-sum payment, and then nothing over the subsequent years. The authorities love this 🤑, you’ll become the tax benefactor of the year. Use the Confederation’s Tax Calculator mentioned earlier, and you’ll see this scenario requires you to pay 160'882 CHF (16.09%) in tax. (Parameters: Lump-sum, residency 8000 Zurich, single, no children, no/other religion, age 65, amount 1'000'000 CHF)

| Account | Payout | Tax | Money left |

|---|---|---|---|

| Account 1 | 1'000'000 CHF | 160'882 CHF | 839'118 CHF |

| Total | 1'000'000 CHF | 160'882 CHF | 839'118 CHF |

In the alternate scenario, you use five Pillar 3 accounts. At this point, you stagger the closure of your accounts: you close one account 4 years from retirement, another the year after, and so on. In this case, each payout is only one fifth the total amount. Let’s compute the yearly tax for this scenario using again the Confederation’s Tax Calculator:

| Account | Payout | Tax | Money left |

|---|---|---|---|

| Account 1 | 200'000 CHF | 11'472 CHF | 188'528 CHF |

| Account 2 | 200'000 CHF | 11'472 CHF | 188'528 CHF |

| Account 3 | 200'000 CHF | 11'472 CHF | 188'528 CHF |

| Account 4 | 200'000 CHF | 11'472 CHF | 188'528 CHF |

| Account 5 | 200'000 CHF | 11'472 CHF | 188'528 CHF |

| Total | 1'000'000 CHF | 57'360 CHF | 942'640 CHF |

And voilà, your tax jumps from 16% → 5.7%, and your money left jumps from 839k to 942k. That’s over 100'000 CHF difference, so this little optimization could pay for your vacation apartment in Portugal 🏄♂️.

Some key observations here.

Is it legal? Yes, it’s perfectly legal.

Is it fair? Yes, it’s fair. As a matter of fact, the large lump-sum payment is unfair because you’re taxed one year as a Millionaire, and subsequent years as a poor bum. Even a split in 5 payouts is unfair, as you’d likely prefer to get that money progressively across the 10–20 years you’ll use it.

Why not 10x Pillar 3 accounts then? Because you can only withdraw Pillar 3 accounts starting 5 years before retirement age.

Finally, balance is fundamental. If you open 5 accounts but 90% of your money is in the first one, you’ll still be destroyed with tax when that one is closed. Ideally, all accounts are equal in value by the time you retire. Here’s how you can do that:

- Either open 5 accounts right when you start, and then make 5 equal payments into each, every year. In 2021, you can deduct 6'883 CHF, so you’d wire 6'883/5 = 1'376.60 CHF into each.

- Alternatively, check your accounts every couple of years, and distribute your total amount into them so as to get them to reach an equal value.

Monitor Pillar 3 options every few years

My review of digital sustainable Pillar 3 products helps you start strong in 2021.

Just like those products make you save a ton of money over your lifetime, new products may come up which let you save further.

Every 5 years, it’s worth to put in 2 hours to check on that. You can use the same methodology I explain in my review, simply applied to whatever new product came to the market, or whatever new features your current vendors have.

If you went for Bank-based options in the first place – as I recommend in this post – you’ll be free to change to potential better options anytime thereafter.

Tweak allocation when approaching retirement

As we looked at maximizing securities, we saw that the stock market occasionally “corrects”, losing a lot of value only to re-gain it a couple of years later – just like the economy goes through crises and then growth.

We’ve seen that despite these corrections, the deal is worth it plenty over longer time. What happens however, if the stock market “crashes” the month before you retire? That may lose you 20-25% of your whole capital right before you withdraw it! 💩

One way to mitigate this risk is to progressively shift your funds away from securities into an account. This means tell your Pillar 3 vendor to switch from a “100% securities” product to a “90% securities, 10% account” product. Two years later, tell them “80% securities, 20% account”, etc. This strategy will reduce risk at the expense of growth: like we saw earlier, money sitting in the account actually stagnates or weakens.

The other extreme of this approach is to stay fully invested in securities until the end. Intermediate versions of this strategy is to shift from securities to capital only at later stages before retirement, e.g. 30%/year in the last 3 years only. You can tune your way based on your own risk appetite.

One final approach is to decide based on how you feel about the economy. You may observe that a crisis struck recently with the economy going through recovery. This requires staying well-informed, and keep in mind that timing the market is always a gamble.

What happens if I die before retirement?

The money currently available in your Pillar 3 fund becomes part of your inheritance, and is distributed accordingly (spouse, children, etc).

What are pillars?

Pillar 3 is called this way because it’s an optional component which can be paid after the 2 other components are. Here’s a summary assuming you are working employed.

| Pillar 1 | Pillar 2 | Pillar 3 | |

|---|---|---|---|

| Purpose? | Bare survival in old age or disability. | Good standard of living. | Discretionary money. |

| Mandatory? | Always, whether you work or not. | Only for employees. Optional for self-employed. | Optional for all. |

| Who pays? | 50% you, 50% your employer. Or 100% you. | 50% you, 50% your employer. | 100% yourself. |

| How much? | ~10% of your salary. | 1-10% of your salary depending on age. | As much as you want. |

| Tax-deductible? | Yes | Yes | Yes, up to a state-defined yearly maximum (~7'000 CHF). |

| Who operates it? | A governmental institution. | A private company chosen by your employer. | A private company chosen by yourself. |

| A.k.a. | OASI (Old Age and Survivors’ Insurance); AHV (DE) AVS (FR, IT) |

BVG (Berufliche Vorsorge-Gesetz) |

As a final note, Pillar 3 comes in two flavors:

- Pillar 3A, which is tax-deductible within limits.

- Pillar 3B, which is unlimited but has no significant tax benefit.

This article uses “Pillar 3” to refer to 3A. Pillar 3B is just another form of discretionary investment with no special interest.

There’s a lot more to know about pillars. For example, there are sub-components to each, some of which optional. And there are different rules if you’re self-employed, or unemployed. Find more details on the swiss social security system.

-

Source: Swiss National Bank, Money market debt register claims of the Swiss Confederation, 3-month ↩︎

-

Source Swiss National Bank ↩︎

-

Source of data: https://datahub.io/core/s-and-p-500, based on data from economist Robert Shiller’s book Irrational Exuberance. ↩︎

-

The price+dividends does not account for divident tax, which may be applied depending on jurisdiction. However, it also does not account for compounding of dividends, which is likely to overcompensate for such tax over time. ↩︎