Quest for the best digital, sustainable Pillar 3 in Switzerland

A 2021 review with an eye to sustainability.

After 13 years of “no"s, I finally accepted an offer by my bank to talk financial optimization. The meeting was during COVID times, and – on my bank’s insistence – it absolutely had to take place in-person.

I went for the masked meeting with the bank advisor, and it was all about Pillar 3A (“Dritte Säule”). A few answers later – reasonable, sometimes sneaky, clearly ready-made – I left the room thinking: There’s got to be better than this!

If my bank sustained itself with such mediocre service, costing me time, risk, and doubt, it was my responsibility to look for competitors more worthy of my money.

In this post

I will talk about:

- Which products I found to be the best digital Pillar 3 in Switzerland for 2021.

- How they fare with respect to sustainability.

- Which other criteria I used to select them.

I will not talk about:

- When and why you should have a Pillar 3 altogether.

- How you can optimize your Pillar 3.

- Why it’s so important to give your money to businesses matching your values.

- How to invest extra savings after you’re done with a Pillar 3.

See post pillar 3 essentials for more details on the omitted topics.

Behind the article

Over 1 Trillion CHF sits in social security funds in Switzerland.

A third of this money – dominantly Pillar 3 funds – is invested in the stock market, helping companies enact their goals and vision. Which companies are invested in has only started to be a topic recently, and most people are still unaware if their money backs companies that cause environmental or social damage.

This post aims to “greenify” some of that trillion CHF, by making it easy for you to choose a sustainabile Pillar 3 product. It is twin with my summary of Pillar 3, which simplifies your job deciding if and how Pillar 3 suits you.

The vendors reviewed here were invited to scrutinize the article, and had their inputs integrated – except for Frankly which didn’t provide any. I otherwise have no affiliation in the sector.

If you wish to inspect methodology or reproduce results, download the Research Package, which includes all data sources at the time of analysis.

Research, writing, and review process of this content took ~40 hours collectively by the involved parties.

Disclaimer: All information on this page is my opinon and for information purposes only. It is not intended as financial advice. Do your own research or seek professional financial advice before taking financial decisions.

Executive summary

Let’s start at the end. Here are the best sustainable digital Pillar 3 products of 2021 in Switzerland according to the criteria I describe.

| Provider | Strengths & when to buy |

|---|---|

| Best overall – low cost, great sustainability, good performance, and extra perks.1 | |

|

Great sustainability and service, at higher costs. Attractive to people closer than 15 years to retirement. |

|

Young player with lowest costs and great sustainability.2 |

And this result is based on the following metrics, which I describe below:

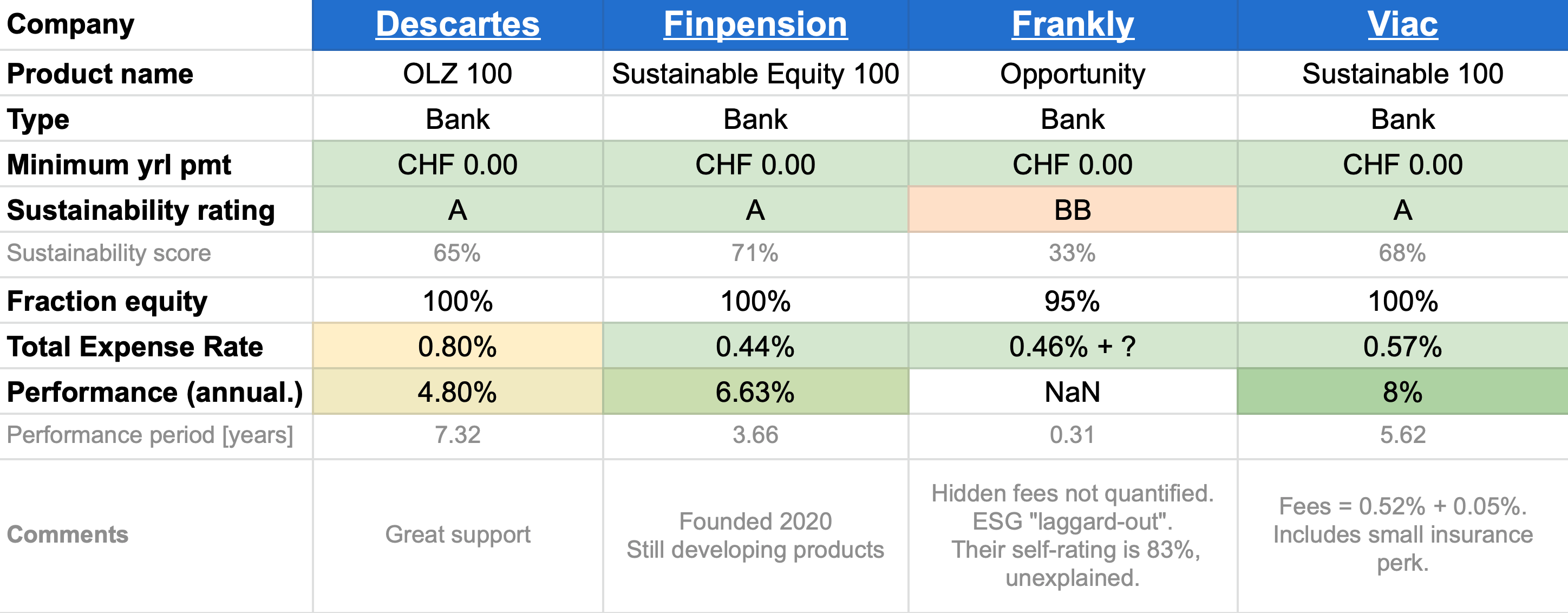

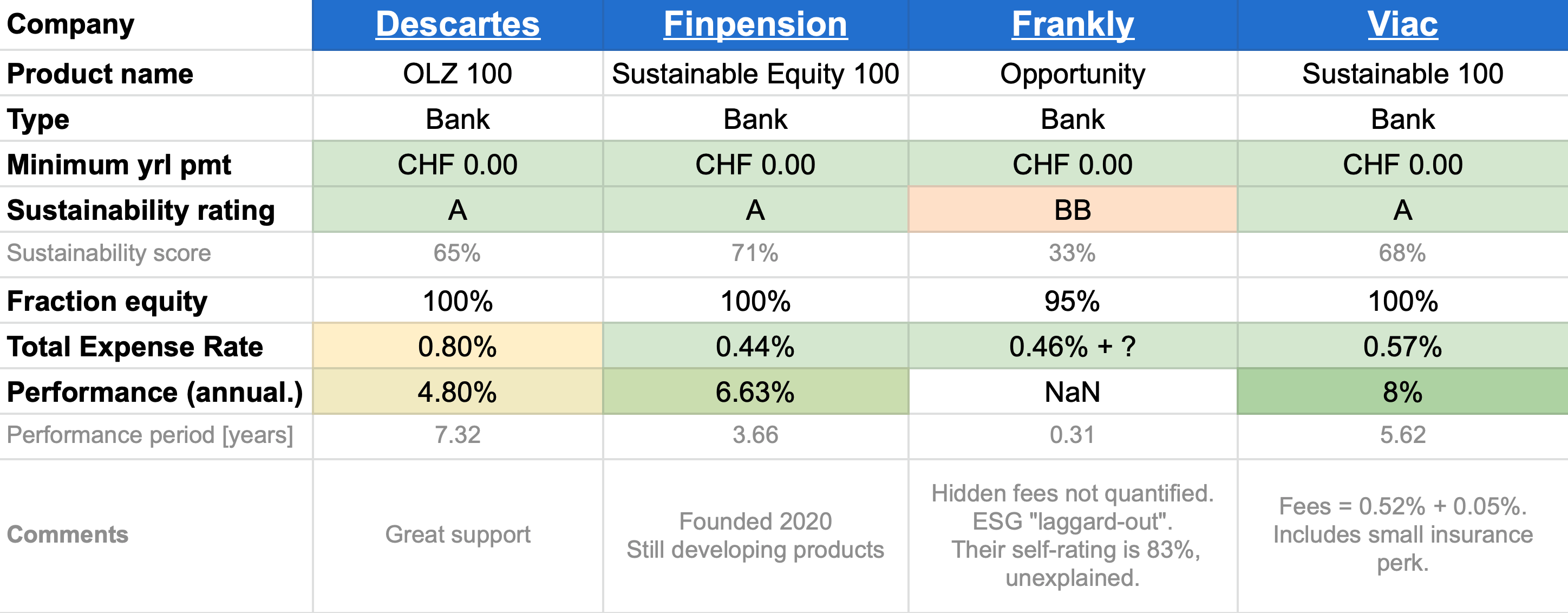

Comparison table of best digital Pillar 3 products in Switzerland.

Yes, Frankly is not among recommended products. Surprised? Read on.

Overview of Pillar 3s and their market

Pillar 3s in Switzerland are funds where you lock your money until retirement, in exchange for tax benefits. It’s a way for the Swiss government to encourage people to save money, which improves the country’s economy and social tissue in a number of ways.

There’s a defined amount you can deposit into a Pillar 3 each year (around 7'000 CHF), and deduct from your taxable income. If your marginal tax rate is a typical 30%, depositing these 7'000 CHF will save over 2'000 CHF in tax each year!

So after you assess whether Pillar 3 is for you – how to use this option? There are many Pillar 3 products, and the market is still more complex than it needs to be. This guide helps you get up to speed quickly, while potentially making adjustments to your own taste.

Observe 2 essential features in your search for Pillar 3 products:

- Generation of Pillar 3: Avoid old generation Pillar 3 products, go for digital ones.

- Type of Pillar 3: Avoid insurance-based Pillar 3 products, go for bank-based vendors.

Generations: Old vs digital

You’ll find 2 main types of offerings for Pillar 3 currently:

- The old generation, agent-based, brick & mortar, dying-off providers. Still the dominant part of the market as of 2021; you want to avoid them.

- The new generation, digital, low-cost providers. Minority players as of 2021, but they’ll be dominant within few years.

Old generation Pillar 3 products typically demand speaking with you. They often won’t just give you information on their product unless you meet face to face, or by telephone. They need to pay time of an agent to acquire each customer.

So my take is to avoid old generation Pillar 3 products at all costs:

- They are extremely expensive for the company to sell (agents’ time, office space, infrastructure etc). Those conversations may cost you tens of thousands of CHF by the time you retire.

- They lack transparency; they won’t give you information offline because their product is not competitive. They need to use persuasion or pressure for you to buy them.

- They will cost you time, because everything requires calling, doing so during office hours, and because they may be obsoleted by the products below within just a few years.

With digital Pillar 3 products, instead, you get more savings for yourself, better transparency, and convenience.

Types: Bank vs Insurance

Pillar 3 products are offered either by Banks or by Insurance institutions. They are both tax-deductible, and have some key differences (typical cases):

| Bank | Insurance | |

|---|---|---|

| Flexibility | 👍 Pay as much/little as you want. | 👎 Pay a minimum amount every year until retirement. |

| Change vendor | 👍 Yes, any time and no strings attached. | 👎 Yes, but only at a substantial cost (saved assets and sale fee). |

| Performance | Comparable with market. | Comparable with market, although higher cost typically reduce it. |

| Disability | Your account continues growing only passively. | 👍 They pay up your future instalments into your fund until retirement. |

For a full comparison, see differences between bank and insurance Pillar 3s.

Choose your vendors

Your overall process could look like this:

- Generate options

- Filter those options as viable/non-viable

- Rank surviving options

- Pick your winner

1. Generate options

I do the obvious: search online and ask friends. I collect those options in a plain list.

All my friends’ options failed my filter right away. They started earlier than me, when old-generation Pillar 3 were still ubiquitous.

This step may produce a lot of results, but my list was still compact:

- Descartes “OLZ 100”

- AXA “SmartFlex”

- Generali “Performa Profit”

- Frankly

- Viac “Global Sustainable 100”

- Finpension “Sustainable Equity 100”

- UBS Vitainvest

Notice that all these products have strong equity components; they are deliberately chosen so to pass the filter below.

2. Filtering criteria

Disqualify vendors that don’t suit you by looking at filtering criteria first. Mine are:

| Filter criterion | Want | Description |

|---|---|---|

| Digital | Yes | Is it a new-school, digital product, or do they require the old, inconvenient, expensive sales process? |

| Minimum yearly payment | 0 CHF/year | Do they force you to pay into the fund every year until retirement, regardless whether you’re employed or in crisis? This pretty much excludes all offers by insurance companies. |

| Equity allocation | > 80% | Do they dominantly invest in the stock market? If not, in my time horizon they are wasting my money in opportunity cost. |

Filtering should greatly reduce the list to few options. In my case, survivors were:

- Descartes “OLZ 100”

AXA “SmartFlex”← Requires minimum payment; Old generation.Generali “Performa Profit”← Requires minimum payment; Old generation.- Frankly

- Viac “Global Sustainable 100”

- Finpension “Sustainable Equity 100”

UBS Vitainvest← Old generation.

3. Rating criteria

Ok, options which survived thus far would all be acceptable products for you. Which one is best?

I used the following rating criteria to compare them:

| Ranking criterion | Measure | Description |

|---|---|---|

| Sustainability | [0-6] | Does the product put your money behind good businesses, or ones that cause harm? |

| Total Expense Ratio | [%] | How much does it cost? What % of your money do they take yearly to fund their operation? |

| Performance | [%] | How much % does your money grow yearly, thanks to their investment choices? |

Let’s look at them individually.

Sustainability

The Pillar 3 product will invest your money into companies. I want to make sure that my money is not used to aid companies which hurt the environment or the broader society.

How do you do that? There’s a measure for this, called ESG score (Environmental, Social and corporate Governenance). Some research institutes, like MSCI, assign this score to each public company based on their behavior. Funds have an ESG score of their own, derived from the scores of the companies they invest in.

How do you use this score to compare your funds? The short version is: simply use my own rating and skip the rest of this paragraph. Sustainability scores are in their early years, and the information is out there but not trivial to fetch and compare.

Still here? Then here’s some more ESG background for you.

You can use either of 2 ways to assess the sustainability of a Pillar 3 product:

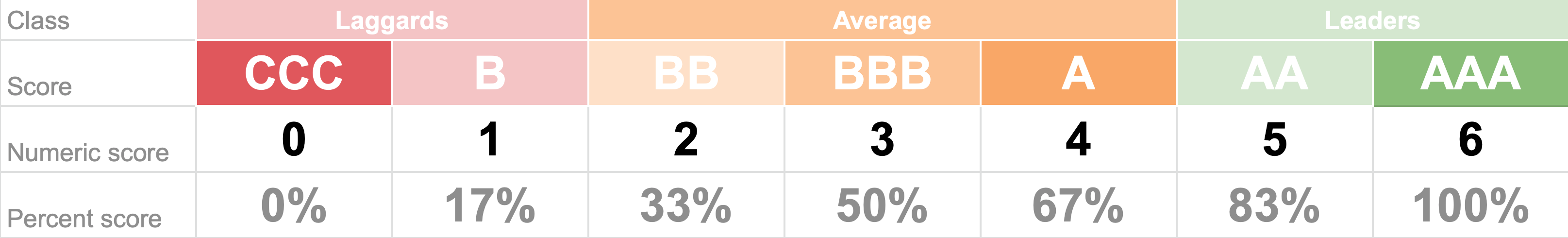

- The quick & dirty way: Search the sustainability claims of the Pillar 3 product for some “inclusion criteria”. They may say – “We exclude companies (or funds) with ESG score below ‘A’”. So

Ais grade 4 out of 6 (see Figure below), and you can approximate sustainability score to be ≥ 66% (worst-case). - The precise way: Search for the funds that your Pillar 3 will allocate your money to. Those funds typically have a Factsheet, which may declare the fund’s ESG score. The ESG score of the Pillar 3 product is the weighted average of the scores of the funds which they invest in.

MSCI’s ESG scores include 7 levels, CCC (worst) through AAA (best) – which I rename as 0 through 6 (or 0% through 100%) to compute averages with.

Try to lookup the ESG score of your favorite company: you’ll see that attaining top scores is rare. Companies scoring ≥ A are pretty good already.

ESG scoring system used by MSCI, mapped to a percentage score.

So that’s ESG score for a company. How about ESG score of a whole investment fund? If a fund claims sustainability, they’ll have some policy to exclude companies with an ESG score below a certain threshold.

You can use that policy for a “quick & dirty” worst-case ESG score of the fund. That’ll often give you a pretty low value, e.g. “Laggards-out” ⇒ 33%.

Use the “precise way” if a worst-case gives you a too-low value. To do that, compute the fund’s sustainability score as the weighted average of the score of each company. Funds sometimes give you the “sustainability” allocation, e.g. “33% is invested in companies with score A, 12 with score AA” etc. The weighted average of these is fine as well.

If the Pillar 3 invests in multiple funds, you get the sustainability ESG score by computing again a weighted average of the ESG scores of the funds.

In my case, I aimed at a score of at least 60% (A).

Total Expense Ratio (TER) = Your fees

Total Expense Ratio or TER is how much money the vendor takes for the service. It’s a % of your whole deposited capital, which they take yearly and regardless of whether their fund made you or lost you money.

TER is typically higher for products with higher equity allocation – in part because managing stocks takes more operational work, and in part because the higher expected returns offset those costs.

TER is a critical factor, especially for young people. Why? The compound effect, where the earnings from interests are re-applied to your growing capital, so they grow exponentially over the years.

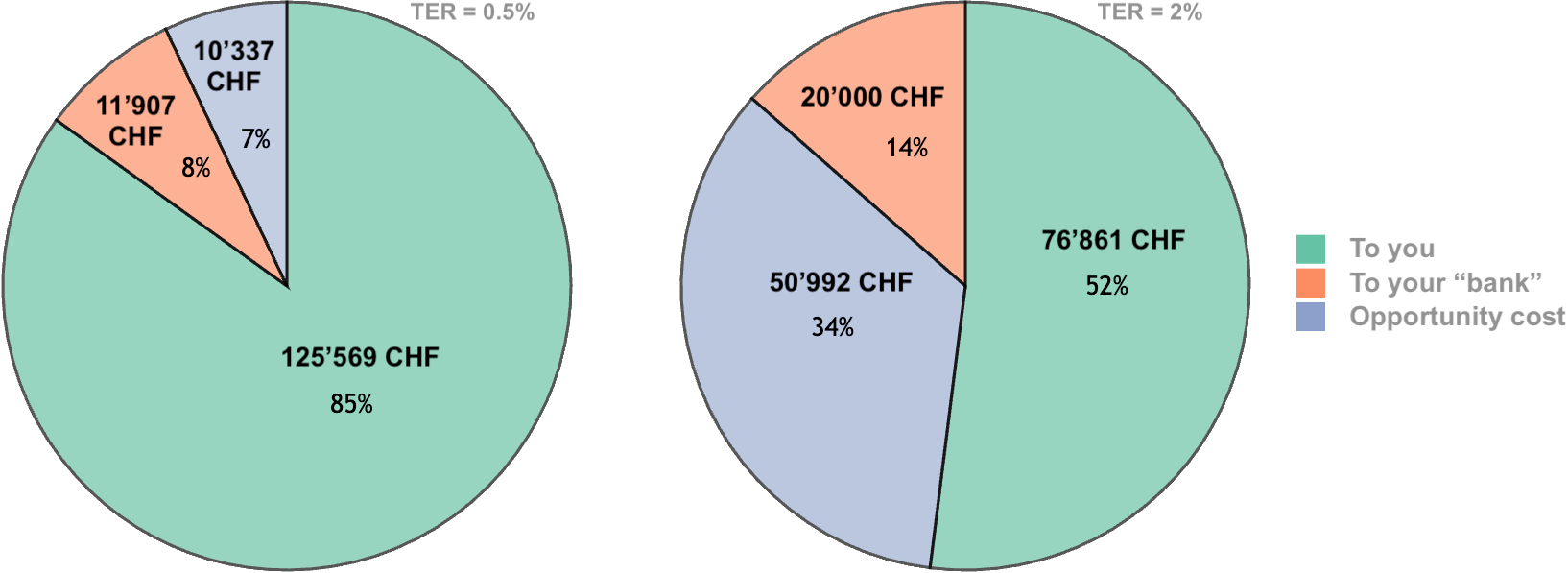

Assume you’re 30 and invest 10'000 CHF into Fund A with TER = 0.5%, and 10'000 CHF into Fund B with TER = 2%. When you retire at 65, Fund A will give you 125'000 CHF, and Fund B only 76'000 CHF. That’s 50 grands lost just for choosing the wrong product! Assumptions: all-stock, average annualized market yield = 8%.

What's left of 10'000 CHF invested for 35 years, with TER = 0.5% vs TER = 2%

Performance

Finally, performance describes how fast your Pillar 3 money grows, and it’s observed looking at how the fund has grown in the past. Take this indicator with a big grain of salt.

First, past performance is no reliable indicator of future performance (go to Japan in 1989 and look back). Second, many funds are only a couple of years old, especially those targeting sustainability – so comparison comes with a strong age-bias.

Still, this measure gives a rough indication of how conservative or aggressive the fund is built, provided that long-term data (5+ years) is available for it.

Non-criteria

Some criteria are disregarded in this comparison:

- Usability. I disregard it because you’ll hardly ever use the app/website. You’ll create your Pillar 3 once, and then only wire them your money each year.

- Brand recognition. Large vendors (like AXA) often mention how many customers they have, working the groupthink bias into you. I could not care less; if anything, I penalize this to foster competition.

- Company longevity. No clear reason to reward or penalize older players. And the youngest bear no risk: if they were to fail, your funds will transfer to another institution.

My rating and analysis

Here’s the result of my own rating (as of March 2021), which you can also explore in detail in a google sheet:

Comparison table of best digital Pillar 3 products in Switzerland.

Let’s look at some explanations.

ESG sustainability

I put extra attention into rating sustainability because the financial sector is ripe with Greenwashing.

Descartes, Finpension and Viac score A (65-71%), which is great: ambitious enough, yet realistic enough for companies to strive for. Focus on the “letter” score rather than the numeric score, as the numeric score fluctuates a bit as companies behave and as funds adjust their allocations.

Descartes and Viac clearly advertise their sustainability policy, so the “quick & dirty” method quickly gets you to a score of 4/6, or A 👍. My rating above shows the score with the precise method, as weighted average of each fund 3.

Finpension requires the precise method. They link their funds’ Factsheets, which mention their MSCI scores – those make the job easier. I simply computed the weighted average as described above, landing them a 71% 👍

The numeric score of Descartes and Viac is a tiny bit under Finpension’s because of stronger investment in Emerging Markets (30% vs 10%), whose industries are not as developed, and consequently have consistently lower scores. Again, this difference is insignificant and you may think it’s good to give those geographies more capital to speed up transition to higher standards.

Finally, Frankly is the hardest to assess. The “quick & dirty” method gets them a poor 33%, or BB: despite all the flashy marketing material on sustainability, their described inclusion policy boils down to a clear “laggards-out”, i.e. they exclude companies with scores lower than B (score=1). The precise method is not applicable, because the fund they invest in provides a score not comparable with others (self-declared, and no methodology description). The actual sustainability score of this product is likely higher, but since there are several good alternatives already, why bother further?

Overall, ESG investing is the future. As more millennials grow into the social security system, demand for such products will grow. And from a performance perspective, I have little doubt that such funds will end up outperforming common stocks, as regulatory trends make it increasingly harder for companies with poor track records to compete.

For more details see my performance rating sheet. For all, the Research Package.TER

TER is acceptable for all products.

Descartes is on the higher end, at TER = 0.8%. This will cost you ~25'000 CHF (~ 5%) over a 25 year span compared with the lowest-cost products. The bulk of those costs come from the fund operator rather than Descartes – and it costs more because it’s a partially actively-managed fund. Descartes opts for this custom approach to minimize volatility, which makes them more attractive if you’re closer to retirement, but still prefer to maintain your Pillar 3 invested in equity.

All other players compete in the 0.4% – 0.6% space, which is likely where future competitors will accumulate. These costs are the “top end”, because sustainable strategies are sold at higher TER. This makes it a great price for us consumers 👍 one solely possible due to the high-automation, low-cost economics enabled by new-generation digital products.

As a last note: The TER declared in marketing materials is occasionally partial, as some companies exclude costs associated with currency coversions and other such operations. These hidden cost are small, and already merged in my ratings figure above where possible.

In particular:

- Descartes and Finpension beautifully embed every cost in their declared fees.

- Viac mentions those costs separately, but quantifies them to be 0.05% over long periods, due to optimization mechanisms they built.

- Frankly only mentions their existance, but does not quantify them, nor do they mention any attempt to optimize them.

Performance

All products have performance 5-8%.

This is in line with the Swiss stock market ~8% of annualized returns – which is a good benchmark as it’s local currency and relatively stable – with a slight reduction because pension managers are motivated to reduce risk (volatility) at the expense of some performance.

Now, you might be tempted to just rank the products by decreasing performance score. That’s a trap. Look at “Performance period”4: Market corrections, recessions or crises occur every 5-10 years as part of the economic cycle, so any “performance period” younger than 5 years is too strongly affected by short-term dynamics.

Viac stands out for high performance over a reasonable period (5+ years). I’m actually impressed by the number, and I expect it to reduce a bit with 1-2 extra years.

Finpension’s number is simply not significant enough, because of short lifetime. Frankly all the more so – 4 months old by the time of this writing. Their own factsheet doesn’t list performance for this reason.

Descartes stands out for longevity. The Performance result was affected by a recent drop in one of their funds, so it’s likely to correct upwards with time.

Finally, you might be tempted to collapse TER and performance together: “Net performance of Viac is 8% - 0.57% = 7.43%”. I prefer to look at them in isolation, because TER is guaranteed, while performance is not. If funds underperform, or a longer crisis lingers, the TER is going to gain prominence over performance.

If you want to dig the details of the numbers, you have full transparency in my performance rating sheet.4. Select

Now comes the grand combined judgement.

Descartes has a good offer for service and sustainability. Their TER has a stronger footprint; combined with their Minimum Volatility strategy, this makes them more attractive for people closer to retirement (e.g. < 15 years away) who have the risk appetite to stay invested in high-returns for longer. Descartes periodically runs Clubhouse webinars which can help you further personalize your financial decisions.

Finpension is your choice if you want the lowest possible costs. They are a young, engaged company with a clear digital roadmap. They’ll have to prove sustained quality and performance over time, and I wish them success.

Frankly clearly did not cut it for me in terms of sustainability. Bring more substance to your sustainability claims and I’ll re-consider. Also, the lack of a track record for the fund they rely on prevents judging their performance. Too many question marks there. Still, I give ZKB credit for being one of the earliest brick & mortar banks to come forward in the digital space.

Viac is the best product overall. Great sustainability, low costs, and good performance. The additional insurance-like protection (either disability or death) is a nice extra, though small as it’ll only grow ~25'000 CHF protection per decade.

Overall, all 3 products are fine choices and you won’t make any major mistake by going for one over the other. It’s great to see a convergence of digital products to similar features, and that they are such an improvement in quality, convenience and costs compared to old-generation ones. 👍

Finally, if you have a Pillar 3 product already and you’d like to change it, check out my notes on how to switch pillar 3.

Conclusion

Here’s take-home recommendations from this post:

- Do consider Pillar 3 for your situation, as it can substantially improve your future quality of life.

- Stick with digital offerings, so your money funds your own retirement, rather than fancy bank buildings.

- Go for products from banks rather than insurance companies to stay free and efficient.

- Consider the socio-economic impact of how your money is used, looking at the ESG profile of the products you choose with your own standards.

-

Ask one of your friends for a referral code to save on Viac fees. Or use my code

WCAqgwd. ↩︎ -

Ask one of your friends for a referral code to join Finpension’s draw for a 6'883 CHF gift. Or use my code

9VK7ES. ↩︎ -

For the meticulous reader: I distrusted the “ESG Rating” of the overall fund as declared by the CreditSuisse Factsheets as one claims

AAAwhen 88% of the holdings have scoreAAor lower; so I scored each fund based on the weighted average of their declared allocation classes, listed in “ESG Rating in Percent vs Benchmark”. ↩︎ -

How is this computed? Compute the age of each fund which the pillar 3 product invests in as the longest period for which performance is available. Then make the weighted average of these ages. ↩︎