Dipping a toe into the stock market

A hands-on report on my transformation from zero to an consistent stock market investor.

Friends periodically ask how to get started with investing – the bare operational, mundane steps such as which account to open, how much money to invest, in which stocks, how to stay invested etc.

This article distills those steps. It’s written for once in the first person so FINMA doesn’t chase me for telling people what to do with their money 😉

Make sure you’re on top of the various precautions we covered: why, types and timing, and safety measures!

And with that, let’s go!

Executive summary

Here’s the overall plan I followed, with some key take-aways for each step:

- Open a broker account – Low fees are crucial to be able to do low-risk investing; Interactive Brokers performed best on that and my other criteria.

- Wire money in – Wiring money in requires a Deposit Notification upfront, and I must pay attention to negative interests.

- Buy the first ETF –

CHSPIis my ETF of choice in Switzerland for safety, reliability and cost. - Define the entry strategy – Spreading out big sums into installments saves me losses in case of unlucky timing.

- Continue investing with DCA – I mitigate the swings of the stock market with Dollar Cost Averaging, buying a fixed amount monthly.

- Diversify – With a substantial capital size, or if I had income in different currencies, I’d buy these additional ETFs too.

Open a broker account

A broker is to stocks what a bank is to cash: it allows you to host them and exchange them with others.

I started off with “eTrading” by PostFinance based on some online reviews, and soon realized how utterly bad they were for fees, service and transparency. A good comparison of brokers for Swiss investors (which he keeps up-to-date!) by The Poor Swiss convinced me that there was better, and worth the pain of migrating.

Two brokers came up on top:

- Interactive Brokers, the world’s largest broker and pioneer of e-trading, US-based.

- Degiro a Europe-based “runner-up”.

Which broker?

Here’s how IBKR and Degiro compare against my main selection criteria:

| Criterion | Interactive Brokers | Degiro | Notes |

|---|---|---|---|

| Headquarters | 🇺🇸 | 🇪🇺 | |

| Fees | 👍 | 👌 | Both good, IBKR better. |

| Fractional shares | ✅ | ❌ | |

| Currency exchange | ✅ | ❌ | Degiro lacks Forex. |

| Security | 👍 | 👍 | Both reliable and protected. |

| Support | 👌 | 👍 | Both reliable, Degiro faster. |

| Usability | 👌 | 👌 | Neither is slick. |

| Product availability | 👍 | 👌 | Degiro lacks the US market. |

Let’s look at those in more detail.

- Headquarters

- Where the company is based. Other branches still exist, e.g. Swiss residents use IBKR’s UK branch, so my money will still land into the local economy for the most part.

- Fees

- What I pay to keep my account and buy/sell stocks. High fees erode savings and choke growth. Most importantly, low fees enable DCA, a form of regular investing which minimizes risk.

- Fractional Shares

- Can I buy less than one share, like tearing a bill? Some shares are incredibly expensive, e.g. Amazon at ~3'000 CHF a piece. Fractional shares allow me to buy e.g. 0.1 stock of Amazon with 300 CHF.

- Currency exchange (Forex)

- Can I convert one currency into another without big costs? This is important if one wants to diversify, and useful in a country 🇨🇭 where 1-in-4 residents is a foreigner, having family or commercial ties working with a different currency.

- Security

- Time-proven, clear business model, and all the necessary regulatory licenses. Brokers protect personal accounts for 100'000 CHF if FINMA-licensed 🇨🇭, 20'000€ if ICS-licensed 🇮🇪 or GICS-licensed 🇩🇪, or 500'000 $ if FINRA-licensed 🇺🇸.

- Support

- How helpful and fast is customer support? IBKR usually takes 2-7 days by ticket, and ~30’ by phone or chat. Degiro lacks chat, but responds faster. That’s in line with banks and OK for me; good it keeps their costs and my fees down.

- Usability

- How easy is operating the account, or making mistakes? Both vendors have non-trivial interfaces which require some learning. I stick with the same operation each month, so I’m satisfied enough.

- Product availability

- What ETFs and stocks can I buy? Degiro offers the European market, plus Hong Kong and Singapore – notably lacking the US. That’s only important if I want to diversify, or have some income to invest in that currency.

The chart below visually compares the costs I’d incur with Degiro, IBKR and PostFinance’s eTrading. Account = base fee. Trade CHF (EUR) = buying one Swiss (European) ETF once monthly, for 1500 €. Currency conversion = change 25'000 CHF into EUR. Transfer = transfer 2 securities to another broker.

My choice for a reliable and efficient broker: Interactive Brokers.

The bottom line is that both vendors are good and only differ marginally, so your national preference might prevail. In my case, it didn’t, and I opted for Interactive Brokers.

As a final note: why not go for “fully free” apps like RobinHood? Because they skim their users’ money by selling their orders to others, who can manipulate (raise) the order price in real-time since most are “market” orders.

Account creation

Once I had chosen Interactive Brokers, how did I open my account there?

- I headed to Interactive Brokers.1

- I completed the profiling questionnaires which they are required to run. (⏱️ ~2 hours)

- I waited for them to validate my account. (⏱️ ~2 days)

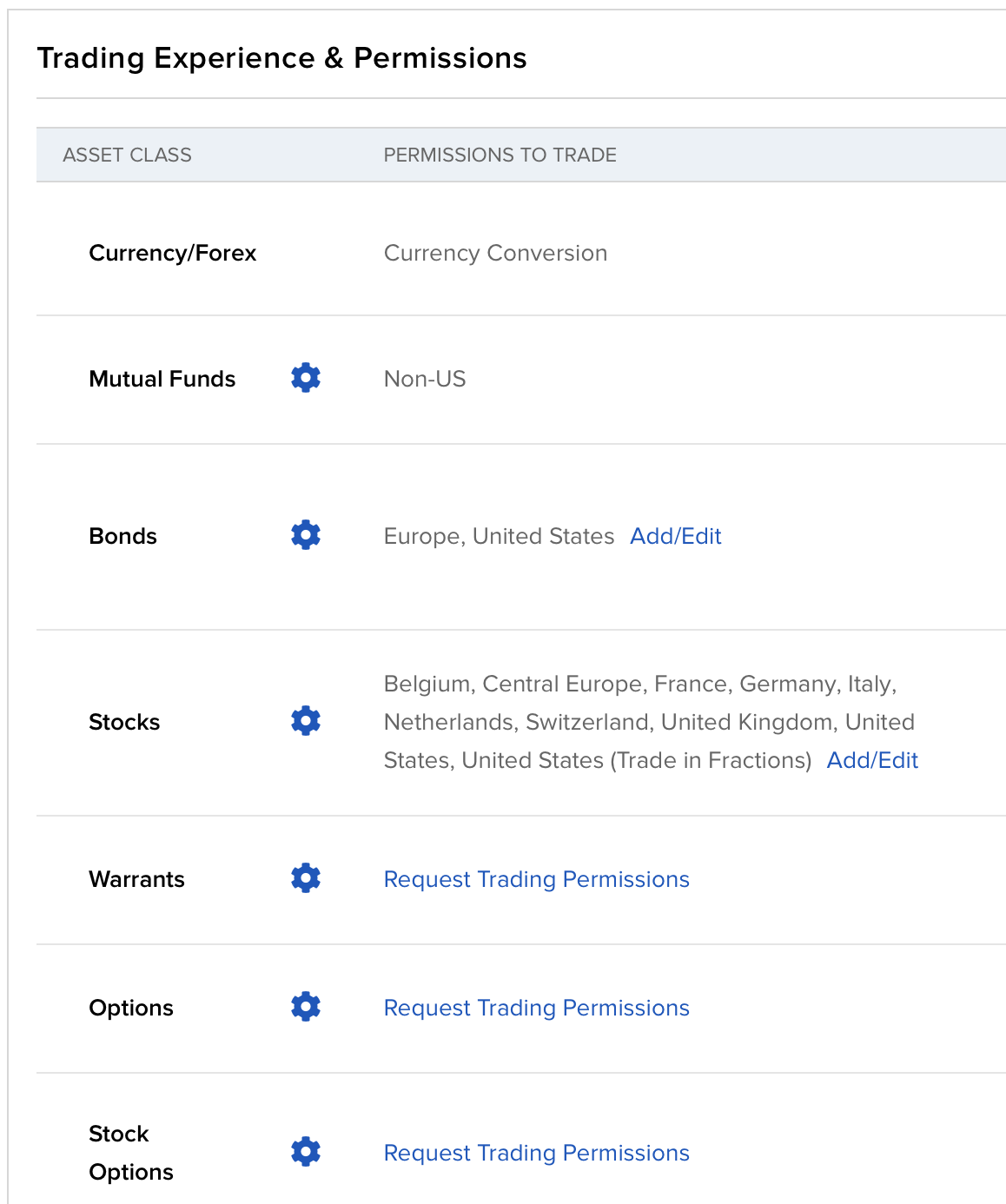

- I requested the trading permissions I wanted, taking their screening tests. (⏱️ ~1 hour)

Most of the time for initial account opening went into fetching the required paperwork, including IDs and proof of residence. I also took my time to thoughtfully answer all questions, as I knew it’s in my own interest.

Sometime during the process (or perhaps after activation), I was asked for two important choices:

- Subscribe for Market Data? I declined that as that tool is necessary for day traders and superfluous to my type of usage. More on the pointlessness of day trading in a future post 😉

- Lend my shares for a share of the profit? I accepted that, because I was still guaranteed to be able to sell whenever I wanted.

After that, I waited 2 business days for IBKR to validate my account. During that time I could play around with “paper trading”, i.e. with fake transactions, but I didn’t bother to.

As I finally got access, I proceeded to request trading permissions for ETFs, in my profile icon → Account settings → Trading Experience & Permissions. There, I requested permissions for “Stocks”, which includes ETFs, for Switzerland, various EU countries, US and UK.

I additionally requested trading permissions for “Bonds” for European countries (including Switzerland) and US – but I ultimately considered that bonds are no good choice in the current negative-interest environment.

Permissions I requested to activate on my IBKR account.

Worth noting – my first tour overwhelmed me with the amount of terms and knobs I didn’t understand. It felt like standing in front of an unprotected running engine: raw, bare and dangerous. I thought “I need to pay d4mn attention here, wrong clicks can cost me work weeks”. I then found that it wasn’t just as bad as I had figured.

Wire the money in

After account activation, it was time to get real, and wire some money into the broker account to buy the ETFs I wanted.

The first question was: how much money to start with? I decided to start my first purchase with a “test amount”, and postpone the definition of my broader investment entry strategy, which I’ll explain later.

That turned out to be the first challenge. I expected to get an IBAN number to wire to – but it ain’t that simple. Instead one has to:

- Notify IBKR with the intention to deposit

- Get their instructions on how to wire it

- Actually wire the money

- Wait for them to receive and release the money

Why this mess? While poorly explained, the reason is simple: They need to give me the right coordinates based on which currency I transfer, and I have no “personal IBAN” because IBKR is no bank.

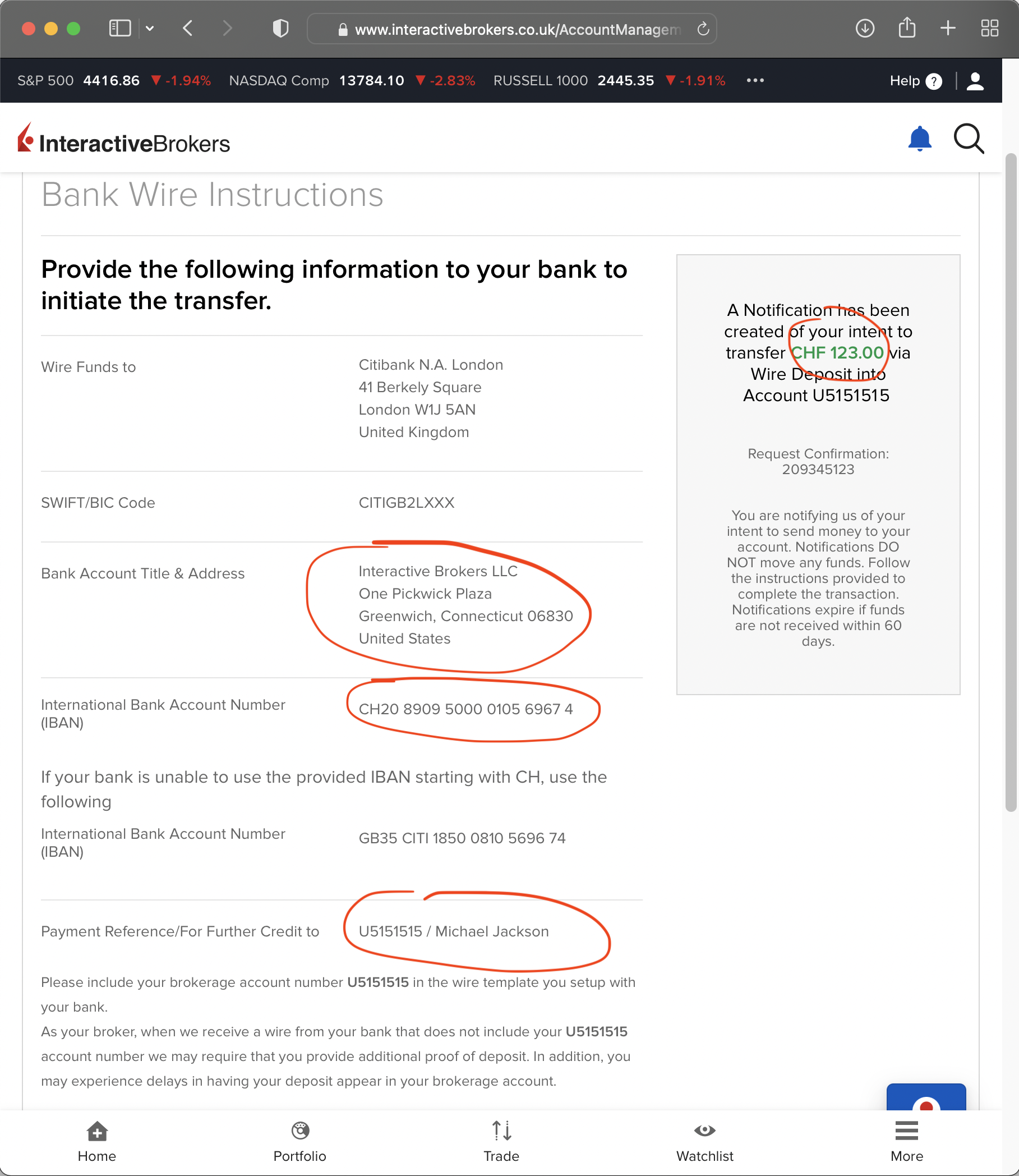

Deposit notification

To make the Deposit Notification, I logged into IBKR and clicked the “Deposit” button. I selected currency CHF, and then “Get Instructions” for payment method “Bank Wire”.

I entered the information on the sending bank and the amount I wanted to transfer, and requested to save this information so I wouldn’t have to type it in each time. Finally I pressed “Get Wire Instructions”.

The page that comes up at that point is crucial!

Wire transfer

The confirmation page at the end of a deposit notification contains all banking information for the transfer. My payment had to match that information, and in particular:

- Mention my IBKR account number in the “description” field of the wire transfer.

- Be sent with the currency indicated. Preferably with the amount indicated too, although it worked for me many times if the amount didn’t match.

- Be sent to the IBAN indicated.

Following IBKR instructions for deposit notification.

What happens next? Wire transfers made from countries like Switzerland and the SEPA region “clear” immediately, i.e. IBKR makes the money available for you to use as soon as they receive it. Since my bank supports SEPA Instant, I have the money available in my broker seconds after confirming the wire payment from my bank’s app.

This is in contrast with less developed banking systems like the US’, where IBKR cannot really rely on the transfer being legitimate: if you transfer USD through the American banking system, IBKR will hold it for a whole week before you can actually use it for transactions.

Interests

The broker pays interests on the cash I maintain on the account, as indicated by the Swiss National Bank.

This means that they take my money too, if the SNB posts negative interests!

This is particularly important if I considered closing my savings account to transfer everything into my broker. If I had 200'000 CHF worth of savings and transferred it into my IBKR account at the time of this writing, for example, then IBKR would take 1.111% of them yearly, i.e. 185 CHF each month! 😱

Buy the first ETF

With the account open, its tank full, and the many thousands stocks available with IBKR, I certainly had a lot of power at my fingertips.

Where to start, then?

CHSPI is my ETF of choice in Switzerland for safety, reliability and cost.In a previous article, I described why I consider broad-index ETFs the right place for most people’s money:

- ETFs are “virtual stocks” aggregating many underlying stocks, similar to Mutual funds, but much more efficient and cheaper.

- Passive ETFs “track” an index which determines which stocks to buy. The same index might be tracked by many ETFs, each with a different price.

I diligently followed through my strategy and bought a broad-index ETF. There’s lots of them, though – so which did I choose?

Which ETF to buy

After lots of research into ETFs, I went for “iShares Core SPI®”, ticker symbol CHSPI. That’s a large, low-cost, sustainable ETF which replicates the SPI® index.

| Currency | Market | Ticker | TER | ESG | Size | Index | Companies |

|---|---|---|---|---|---|---|---|

| CHF | 🇨🇭 | CHSPI |

0.10% | 76% | >2B | SPI | 250+ |

The overall process I followed to choose the ETF was as follows:

- Choose which index I wanted to follow. There’s only 1-2 broad indices per economy. e.g. SPI® in Switzerland, S&P 500® in the US, DAX in Germany etc.

- Find all available ETFs that track that index.

- Collect my key criteria for each ETF and choose the one rating best.

What are these key criteria, then? Let’s have a look at the columns summarized in the table above.

- Currency

- What currency do I need to buy the ETF? This determines if my money will be converted when I buy and sell it. Also, it reveals hidden currency conversion costs in the fund, if they buy companies in other currencies. As a Swiss resident, I wanted my main investment to be in Swiss Francs.

- Market

- In which countries or economies does the ETF buy stocks? This suggests how stable it is, what growth I can expect, and if there’s any currency exchange incurring cost and risk. For my principal investment, I wanted to stick with Switzerland: if the economy slows, prices would slow accordingly – so I’m safe.

- Ticker

- A few capital letters which identify a stock for a broker. Not a global standard, funny enough! Actual global identifiers are ISIN and CUSIP numbers – so you might search for those too. In this article, I simply refer to the ticker used by IBKR.

- TER = Total Expense Ratio

- The cost of the ETF, charged to your total investment every year. We looked at why a low TER is critical in a previous article. Mutual funds often have TER = 1-2%, while good ETFs have half that.

- ESG

- A rating of the company’s behavior with respect to Environmental, Social and Governance factors, as we covered in a previous article.

- Size

- How much money has been invested into this ETF (a.k.a. “Net Assets”). Small ETFs are more likely to close and make you relocate. Worse yet to have low liquidity, preventing you from buying or selling when you want to do so. A size >250 Million CHF is OK.

- Index

- An index determines the allocation, i.e. which companies to buy and how much of each. The ETF enacts the index by actually investing the money proportionally into those companies. You typically choose your investment strategy through the index, find multiple ETFs which track it, and pick one based on its TER, size and reputation.

- Companies

- How many companies the index invests in. I mention this because I recommended sticking with broad-index ETFs for safety and for profit.

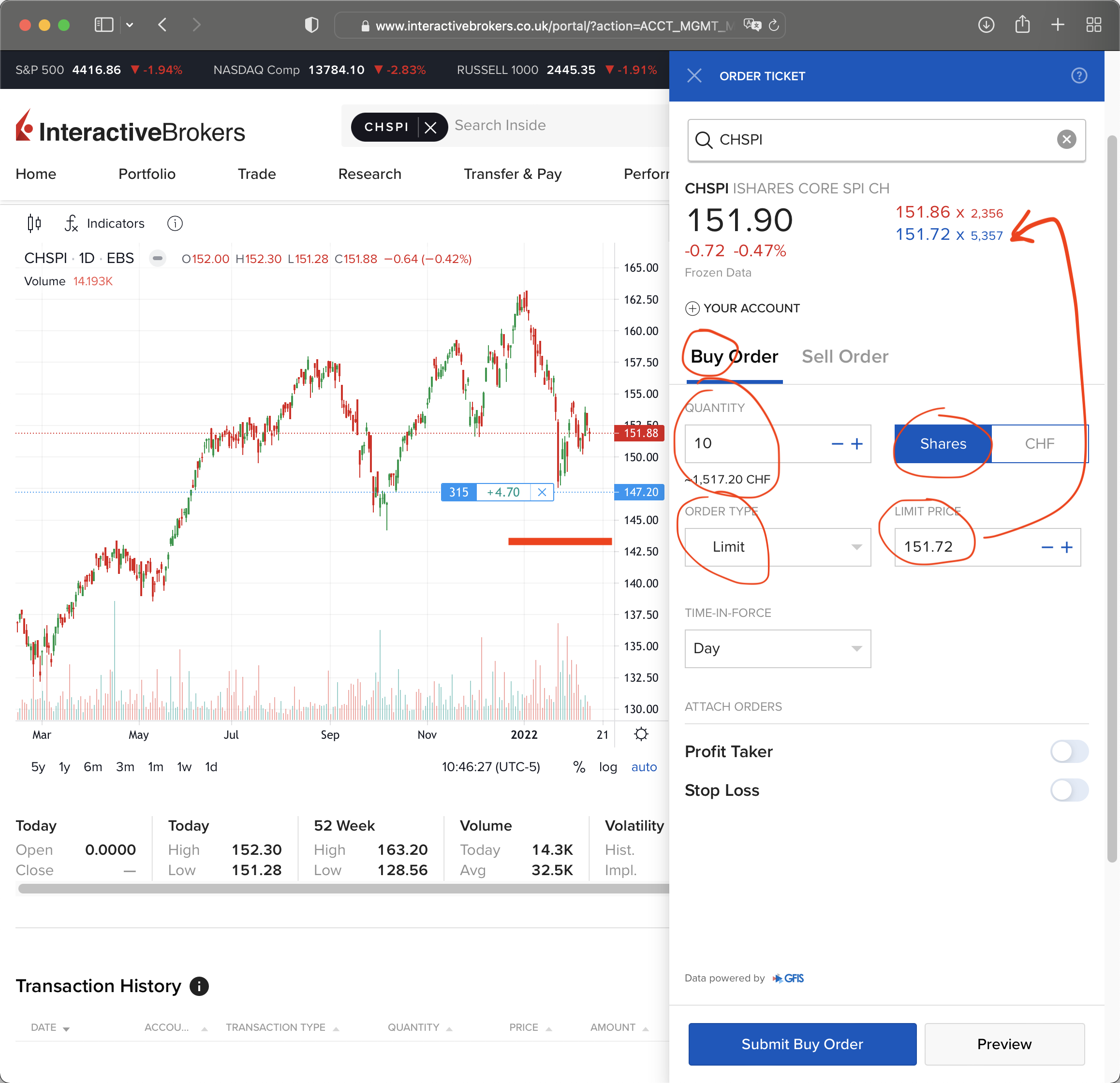

How to buy it

With the actual ETF chosen, there I was, at the apex of the whole process, about to actually buy the ETF! 😨

It turned out easier than expected:

- I logged into my IBKR account.

- I typed

CHSPIin the big search bar at the top of the Home screen. - I got one result suggested: “ISHARES CORE SPI CH - EBS” – and clicked it accordingly.

- I selected the “Stock” type. Other options might show with more permissions enabled. (e.g. shorting)

- This showed me the price chart of

CHSPIover time. - I pressed button “Buy”.

At this point, I reached the “Buy Order” form in the figure below.

Buying the CHSPI ETF on Interactive Brokers.

Here’s how I filled out the parameters it required:

- Quantity: I entered the number of shares I wanted to buy. I had 1'600 CHF available, and the price was ~151 CHF/share, so I had room for 10 shares. I could have bought fractional, but opted for simplicity. I also verified to have “Shares” selected as a quantity unit.

- Order type: I selected “Limit”, which means “only buy if the price falls below my limit”. More on this shortly.

- Limit price: I entered the price of the current “Bid”, i.e. the currently highest offer. More on this shortly.

That makes the order ready to submit. Before pushing that button, let’s first fully understand the Limit concept.

When you buy stock, you might choose a “Market” order to buy at whatever price is currently asked for. So if the “cheapest” seller wants 152 CHF/share, you’d pay that. Market orders cost a little more, because they take liquidity from the market.

With “Limit” orders, instead, you set your price, and wait for some seller to accept it. This saves you a few CHF in commission costs, at the expense of risking that your order doesn’t actually get filled.

By setting your limit price to the current “Bid”, you match the best offer of other buyers. Doing so raises your chances to actually get your transaction done – which is in my experience over 80% – and avoids pushing the stock price up.

If you accidentally enter a price higher than the current bid – say 1520,0 instead of 152.00 – that’s no drama: IBKR will automatically adjust your price to the current “Ask” and execute the order. That will make the order be charged as a Market order though.

And there it was – my order ready for submission. I pressed “Submit Buy Order”, and monitored it for a few minutes before until it got filled. I’d then go to “Portfolio” to see my first shiny stock showing up! 😁

If I were to do that operation during a steady price hike, my order might expire before my price is reached. I’d simply enter a new order the next day and get on with my life.

Define the entry strategy

After deciding to stop losing money with my savings account, how much to invest?

I determined that using my considerations on safety, and also what safety buffer to keep. After a first “test purchase” for practice, I asked myself:

- Should I invest all the money I allocated at once to minimize opportunity cost?

- Or should I use multiple purchases to minimize concentration risk? How many?

I opted for the latter, following an approach called Dollar Cost Averaging – recommended by most of Key Opinion Leaders in conservative investing (Warren Buffet, Charlie Munger, Peter Lynch etc). Now here’s what those KOLs fail to detail:

- How long should my entry period span? The longer time, the lower volatility risk, but the higher opportunity cost.

- How many purchases should I make during that period? The more payments, the lower volatility risk, but the more money wasted on commissions.

I set the entry period to 12 months, half the average time between stock market crashes in the last 50 years.

For how many purchases, I decided I’d accept a total entry cost of 0.25%, and observed that the Swiss stock exchange takes a ~5.00 CHF fee per transaction (one of the world’s most expensive!); so payments had to be ≥ 2'000 CHF.

All in all, here were my possible game plans for an entry strategy over 1 year, depending on how much savings I had to invest:

| Total savings | Installment number | Installment amount | Interval | Comm.s | Total cost |

|---|---|---|---|---|---|

| 2'000 CHF | 1 | 2'000 CHF | – | 0.25% | 5 CHF |

| 4'000 CHF | 2 | 2'000 CHF | 6 months | 0.25% | 10 CHF |

| 8'000 CHF | 4 | 2'000 CHF | 3 months | 0.25% | 20 CHF |

| 12'000 CHF | 6 | 2'000 CHF | 2 months | 0.25% | 30 CHF |

| 20'000 CHF | 10 | 2'000 CHF | 6 weeks | 0.25% | 50 CHF |

| 40'000 CHF | 12 | 3'330 CHF | 1 month | 0.15% | 60 CHF |

| 100'000 CHF | 12 | 8'330 CHF | 1 month | 0.06% | 60 CHF |

Continue investing with DCA

Once all was set up, how did I plan to invest the upcoming savings I could put aside from my salary?

I first determined what part of my monthly savings I would actually invest after doing the powerful accruals exercise. Then, I decided how often to invest it: frequently while not exceeding 0.25% commissions. That meant monthly for me, and just after the salary would come in.

Purchasing a stock at regular intervals and regular amounts is what’s called Dollar Cost Averaging, or DCA. Buying in Swiss Francs? It doesn’t matter, that’s still the name 😂

DCA has 2 main purposes:

- It mitigates the risk of buying at a bad time.

- It establishes a routine which makes me indifferent to the swings of the stock market.

The latter is subtle but powerful, because psychology is a major source of losses in the stock market.

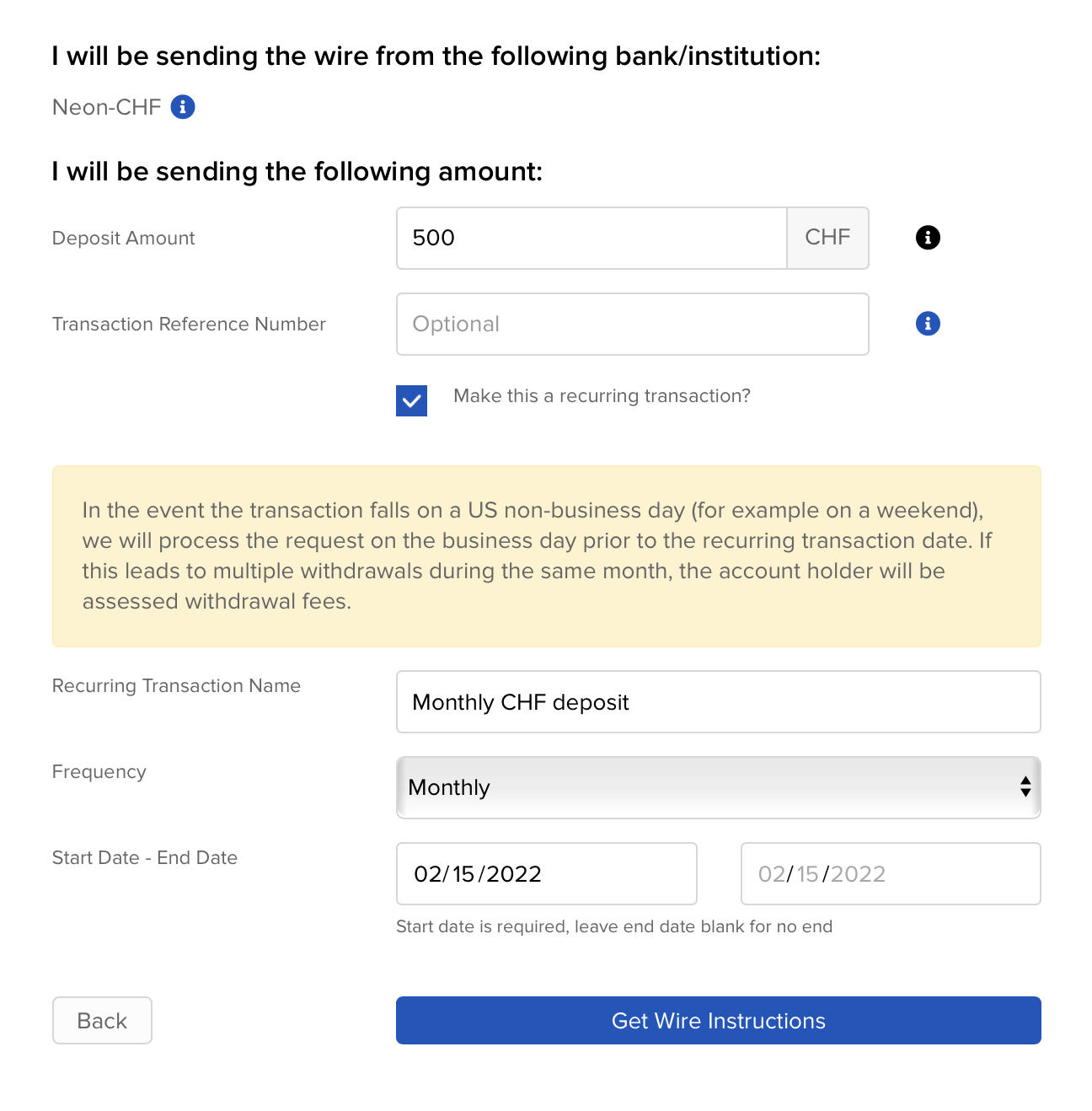

Here’s how I implemented DCA with IBKR:

- I computed what amount I wanted to invest monthly, after accruals – say 500 CHF.

- I went into IBKR and set up a Deposit Notification like before, but checked the “Recurring transaction” option (Figure below), for 3 days before my payday.

- I went into my e-banking, and set up a recurring wire transfer to the coordinates received from IBKR, occurring at my payday. Importantly, I mentioned my IBKR account number in the transfer Subject.

- Every month, the day after my payday, I would open IBKR and purchase the available amount of

CHSPIstocks.

Setting up a recurring deposit notification with IBKR.

The key for successful DCA is to stay stupid:

- No change to the amount.

- No change to the periodicity.

- No (significantly) change to the date when I buy.

- No skipping periods.

Bundling purchases

If the strategy for investment entry lasts a whole year, how to combine it with new savings?

Also, how to handle dividends which are earned every quarter from the ETF?

The answer is simple: bundle all payments into each month’s purchase. Here’s an exemplary schedule if I had 40'000 CHF of savings to invest in 12 months, and new savings of 600 CHF each month from my salary – and started the process in January:

| Date | Old savings | Salary savings | Dividends | Purchase |

|---|---|---|---|---|

| January 26 | 2'000 CHF | 600 CHF | – | 2'600 CHF |

| February 26 | 2'000 CHF | 600 CHF | – | 2'600 CHF |

| March 26 | 2'000 CHF | 600 CHF | 23 CHF | 2'623 CHF |

| April 26 | 2'000 CHF | 600 CHF | 62 CHF | 2'662 CHF |

.. etcetera, no rocket science there! Dividends are put by the broker onto my account automatically, so whatever I find there at the end of the month, I invest.

When to sell?

Never! 😉

The plan I described above uses time and GDP growth to multiply my savings. My securities sit in just like my savings used to do in the bank.

Selling is the endgame, hopefully when I’m retired and they’ll be worth multiple times what I deposited. I will sell earlier if I need money, a sign I made some mistake during my safety planning exercises.

Selling for the purpose of re-buying at a lower price constitutes trading, a practice which lures most individual investors and makes them lose money2.

Diversification

There. My broker account, an ETF in my portfolio, and even a recurring system to make the best of my savings over the years. What could I want more?

Nothing!

But if anything, then some diversification.

Here’s some reasons why I might what that:

- If I had dealings in different currencies, e.g. some rental income from an apartment abroad.

- If I wanted to take some risk to capture the higher growth of other markets.

- If I had a large investment in CHF already and wanted to avoid keeping all eggs in one basket.

- If I considered retiring in another (developed) country.

In some of those circumstances, here’s some of the diversification strategies I would employ:

- Invest in REIT (Real Estate Investment Trust) funds – to aim for less volatility at the expense of growth.

- Invest in broad-index ETFs covering Emerging Markets – to aim for growth at the expense of more volatility.

- Invest in broad-index ETFs with other reserve currencies – to hold some USD and EUR.

Here’s my selected ETFs for that:

| Currency | Market | Ticker | TER | ESG | Size | Index | Companies | ISIN / CUSIP |

|---|---|---|---|---|---|---|---|---|

| CHF | 🇨🇭 | CHSPI |

0.10% | 76% | >2B | SPI | 250+ | CH0237935652 |

| CHF | 🇨🇭 | GREEN |

0.60% | – | >2B | SXI | – | CH0100778445 |

| USD | 🇺🇸 | SUSL |

0.10% | 84% | >3B | MSCI USA Extended ESG Leaders | 250+ | 46435U218 |

| USD | 🇨🇳 🇹🇼 🇿🇦 🇰🇷 🇮🇳 | SUSM |

0.25% | 86% | >3B | MSCI EM SRI Select Reduced Fossil Fuel | 150+ | IE00BYVJRP78 |

| EUR | 🇫🇷 🇩🇪 🇳🇱 | SLMA |

0.12% | 94% | >1B | MSCI EMU ESG Screened | 220+ | IE00BFNM3B99 |

| EUR | 🇬🇧 🇫🇷 🇨🇭 🇩🇪 | IMEA |

0.12% | 90% | >5B | MSCI Europe | 400+ | IE00B4K48X80 |

Conclusion

A few hours work had me up & running in the stock market; time and money now work during my sleep! 💪 🚀

We looked at three reasons causing the Swiss to hold money in the bank:

They regard the bank as the safest place for savings, with alternatives being risky.✅They are unwilling to invest time for understanding alternatives.✅They fall short of executing after they did decide for alternatives.✅

This article addresses the third and final point: execution. A low-cost, reliable broker combined with the discipline to re-invest regularly in prudent broad-index ETFs, is a strong recipe to create financial comfort in the later decades of my life.

This also brings the mini-series on the wealth gap to a closure. This mini-series aspired to make the benefits of prudent personal finance accessible to a broader base of people.

What’s next from here? The ethicality of the stock market; how to increase discretionary income; the pitfalls of active trading – are future candidates. Cast your opinion in the comments below.

Also, found any itchy content in this article? Unclarities? Missing context? Plain mistakes? Add comments with your input to the public gDoc version and I’ll consider merging them!

Glossary & essential concepts

- Discretionary income

- The amount of money left for you to spend after all basic necessities (lodging, food etc) are covered. It’s disposable income minus the cost of basic necessities.

-

This is an affiliate link. Starting from it will bring both you and me some small benefit. My product choices are independent of referrals – I choose products before knowing if referral programs are available for them altogether. ↩︎

-

Source: The behavior of individual investors, B. Barber and T. Odean. ↩︎