Energy; inflation; recession; stock market crash. Time to change strategy? Stop!

A traffic jam of bad news, and most people's investment portfolios currently look red. Time to change strategy? Not so fast!

Feel a little battered by the current pile of “sub-optimal” news? I certainly feel that way 🙄

📺 Energy crisis; Stock markets crashed worldwide; signs of recession; inflation like in developing countries.

📰 Chip crisis; rising tensions in Asia; disrupted supply chains; war of expansion like in the middle ages! 🔥

Perhaps you even started investing enthusiastically during COVID and now feel stuck and a little insecure on how to move forward.

I review the situation to gain some clarity. Is the plan I used so far viable for the near future? Was it wise for me to invest during COVID at all?

How to move next?

Executive summary

Here’s my key take-aways from this post:

- News are grim and the situation is not ideal. But not terrible either:

- Inflation is high, but corrects a looong period where it was undesireably low.

- Half the signs of recession are missing.

- We only need to fix a little of the energy problem to get it a lot better.

- Doom is always there when you want some. Shrug it off!

- Don’t change the course by the wind.

- Time in the market. No timing the market.

Behind this article

COVID and its lockdowns produced a lot of new Swiss investors – with extra time at hand and excited of finding more money left at the end of the month.

Come 2022 and society is mostly back to normal. But the cheerfulness has not gone up for them 🤣 On the contrary, many are concerned about the situation or self-conscious on their past deeds 🤕

And to top it all, those same video platforms which comforted solitude during lockdown now feature experts with doomsday predictions.

Most private investors lose money because they “buy high and sell low”. Avoiding the former is difficult and unnecessary.

The important part is to avoid the latter. And in this post, I make the case for exactly that.

If you wish to inspect methodology or reproduce results, download the Research Package, which includes all data sources at the time of analysis.

The news

📉 17-odd percent!! 😱

That’s how much the Swiss stock market has lost since its peak value of December 2021. And it mirrors those of other western countries 🇺🇸 🇩🇪 🇯🇵 to be a bear market, as insiders call those that lose 20%.

Drop of the SPI.

So the sentiment is not best among investors. And I am not surprised, if I look at the current news:

- Inflation is at levels unseen 🔭 by anyone in my generation; I had to fetch Baby Boomers to recollect something similar.

- Most western countries reported negative ⬇️ GDP growth for 2 quarters, which some consider recession.

- Europe plans to ration energy this winter ❄️, starting with businesses, which will cause further economic contraction.

- Several prominent experts (Michael Burry, Ray Dalio) claim 📣 it’ll get worse.

All of those news seem pretty scary. But fear is the best ingredient to trigger my attention, so I know that’s overrepresented.

What other data do I need to get a fuller picture?

The ground: Inflation

Yes, western countries currently experience large inflation. That’s 4% in Switzerland 🇨🇭, and over 8% in both Eurozone 🇪🇺 and US 🇺🇸.

However, this follows over a decade of zero or negative inflation. That’s important, because we know that those countries actually seek a target yearly inflation of 2%! That means a deficit of over 22% to catch up, with a negative effect on employment, attitude towards saving and consumption, and monetary policy.

Now, central banks certainly don’t want an uncontrolled hike in prices – but at the same time, the do welcome a higher inflation slowly compensating part of that “inflation debt” which they accumulated over a decade.1

So they currently play a soft hand to taper inflation until stabilizing it at the target 2%, as the current state isn’t as bad as we think and they don’t want to suddenly choke the economy and cause job losses.

Additionally, a lot of the current inflation is caused by narrow, temporary effects:

- COVID’s leftover challenges on supply chains, which have already started to ease, while

- Companies have significantly better inventories, and some too much of them.

The ground: Recession

Yes, several countries have reported a GDP decrease for the second quarter in a row, which some consider to be recession.

However, other signs from the economy do not paint a grim picture.

Recession involves rising unemployment and falling consumption.

First, unemployment at historical lows. Too low, in fact!

Economists use the “NAIRU” (Non-Accelerating-Inflation Rate of Unemployment) to define a desireable range of unemployment. Employment lower than NAIRU causes issues like soaring wages and companies getting stuck with finding talent instead of building stuff.

Here’s how we currently stand with unemployment compared to NAIRU2:

| Country | NAIRU2 | Unemployment (summer 2022) | Gap |

|---|---|---|---|

| Switzerland 🇨🇭 | 4.1 % | 2.0 % | -51 % |

| France 🇫🇷 | 10.1 % | 7.3 % | -28 % |

| Germany 🇩🇪 | 7.8 % | 5.4 % | -31 % |

| Italy 🇮🇹 | 10.4 % | 6.6 % | -36 % |

| UK 🇬🇧 | 6.7 % | 3.8 % | -43 % |

| US 🇺🇸 | 5.2 % | 3.4 % | -35 % |

| Australia 🇦🇺 | 7 % | 3.4 % | -52 % |

| Japan 🇯🇵 | 3.9 % | 2.6 % | -33 % |

For comparison the Great Financial Crisis had unemployment over 10% in the US, and 23% was seen during the Great Depression.

Besides economic data, it also doesn’t appear as though our Job Sentiment is packed with fear of not finding work next month! We’re out of COVID and companies are still endearing us with special conditions to fight the Big quit, which is still going on.

Consumption has also stayed high, which is why inflation soared so high after the leftovers of supply challenges.

All of which is why the US Federal Reserve announced a decline in GDP for the 2nd quarter in a row while saying “but we don’t consider this to be recession”. A statement that many accused of twisting reality. Superficial judgements aside, the statement actually has its grounds.

The ground: Energy

Energy prices spiked after Putin’s war games.

This spike – about 10 times higher the former average price – is caused by consumers demanding more energy than suppliers can deliver.

Who should pay?

Such 10x spikes made me put things in perspective as I heard energy bills increasing 20% to 80% in some countries:

- Many utility companies went bankrupt in the UK 🇬🇧 because the government prevented them from raising prices to consumers. France 🇫🇷 nationalized their energy operator and is taking on the costs as national debt.

- Governments control energy prices because rises often get people onto the streets, causing major issues like Yellow vests protests, or even proving fatal for the government, like in Kazakhstan and Sri Lanka.

The problem with appeasing us – the people – in that way is that it kills the power of price. Prices serves the important function of ensuring that scarce resources be used sparingly. If we demand low prices while gas is very scarce, we’ll happily keep burning it at the usual pace until it suddenly runs out.

For these reasons I’m glad to take higher energy prices in the next months. I’ll use them as a challenge: keep my bill same-cost by optimizing my consumption. A friend already guided to a 5% yearly reduction with a simple trick! That’s how I think a model citizen would play its part in this crisis.

Why 10x?

Now, how could a reduction of less than 40% of energy cause a 1'000 % spike in its price anyway!?!

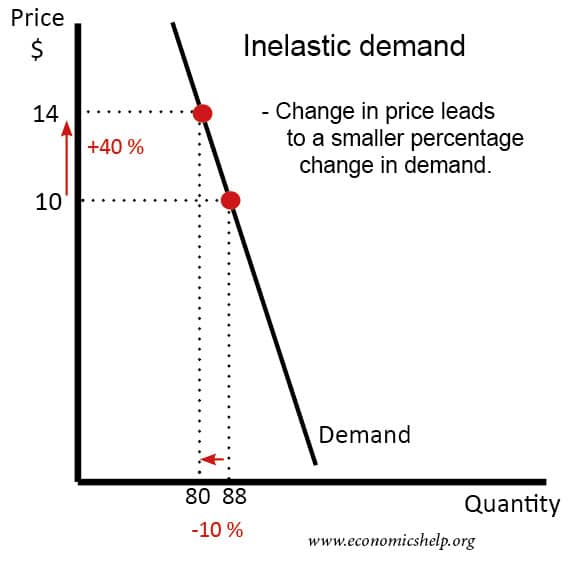

Energy is an inelastic market, like pharmaceuticals and food: products so precious and irreplaceable that buyers will pay whatever price to get some.

Inelastic energy means small reduction in demand decreases price heavily.

But the same dynamic which brought prices up so brutally and suddenly also works in reverse. That means, every little decrease in the need for that gas will bring prices down strongly.

And several factors indicate progress there:

- Most European countries were already reducing their overall energy consumption since the mid 2000s, per-person and total. The current situation will only accelerate that.

- Germany 🇩🇪, the largest driver of price increases, reduced their imports of Russian gas from 55% to 26% in few months, by raising imports from Norway 🇳🇴 and the Netherlands 🇳🇱.

Finally, the diversification effort underway also reduces the chances of similar crises in the future. All major energy crises were either caused or aggravated by a shock in supply, and always originated in a third country. As Europe 🇪🇺 becomes more self-reliant, those power dynamics will wane.

The energy situation will likely get worse before it gets better, but we don’t need to fix all of it to return to normal – we only need to get rid of the “crazy” prices.

That’s a great opportunity for well-intended citizens to help! Monitor your energy consumption; challenge yourself to see where and how you could reduce either your gas or electricity use!

The ground: Experts of doom

Finally, some perspective on experts broadcasting predictions of economic catastrophe on press, YouTube and TV.

They always do.

Here’s one example:

Expert: “The stock market is near all-time highs. [..] But this rally is coming to an end. The writing is on the wall.. [50-70%]” – James Dale Davidson (correctly predicted dot-com and GFC crises), May 2016

Reality: The stock market gained 45% in the subsequent 3 years.

Here’s another:

Expert: “Quantitative Easing will cause Hyperinflation and suppress the US dollar” – Peter Schiff (correctly predicted GFC), 2010

Reality: The US stock market gained 27% in the subsequent 18 months.

And another:

Expert: “The economy will enter 2-digit interest rates due to inflation” – Alan Greenspan (former Fed Chairman), Sep 2007

Reality: Inflation stayed ~0 for the subsequent 12 years, along with interest rates.

Some do so even routinely:

Expert: “legendary investor [Jeremy Grantham] has been calling for a crash for more than a decade, and none has yet come.” – Business Insider, Jan 2022

Reality: 2012 through 2021 saw one of history’s strongest markets, +250%.

You’ll always find some reputable expert preaching imminent disaster.

It doesn’t mean that they are lying. They genuinely think what they say. It also does not mean it will happen. Sometimes it does. Often it does not. You never know, and that’s the problem: Those expert opinions are just not reliable information. It’s only noise.

Noise which – unfortunately – gets over-represented in news because fear triggers your attention. And after that, you over-represented it to yourself due to the Availability bias.

How to invest going forward

Based on the above I have no more reason to expect the markets to go further down than I have to expect them go up.

Does that ring a bell?

That’s the situation I am in pretty much 99% of the time. Which is why I stick tight to the strategy I adopted by looking at 100 years of stock market history:

- Define an amount of money you can safely invest each month.

- Invest that money each month, on the same day, on the same ETF you have chosen.

- Don’t let the information noise alter your strategy.

Why is this important? Here’s what happens when I don’t do that:

Cost of feelings-based investment.

The above is “feelings-based investment”, affecting many new investors: They start with some confidence and keep investing as the markets go up, but lose confidence and stop investing when they go down.

See what happens to their average cost if they do this instead of sticking to the strategy!

With the observation above, I stick to the strategy. I know that at some point, in one, three or five years, the markets will come backup up and I’ll grin thinking of the great price I obtained for all my purchases until then. And the dividends!

One extra hint I’d add for myself, for “noisy” periods, is: Don’t let the information noise even bother your peace of mind. Hear them out and shrug them off.

Was it wise to invest during COVID?

Let’s review this with by looking at two scenarios of high uncertainty:

- What if I started investing at the unluckiest time – the beginning of 2021 – so I was “all in” right before the markets crashed?

- What if I started investing in the chaos of the beginning of COVID?

I’ll assume that:

- I had savings available for 24'000 CHF to invest just before starting.

- I started investing using the entry strategy I previously covered. That’s 12 purchases – one a month for a year.

- I invested in the

CHSPIETF, again as I previosuly covered.

If I did all of the above, but terminated my investment right after entry, then my investment now would be worth 7.9% less than I started with.

I hear 17.5% in the news, but my figure is already better because of my entry strategy. 😏

But wait, there were dividends too!

Let’s count those. I’ll assume that I continued my “long walk” strategy by investing the 500 CHF/month I could set aside each month, topped with whatever dividends I received.

There you go: with all that, my current balance would be 6.9 % down from the money I invested.

Now, that’s still less money than I put in to be sure! 😆

The point of this review is to put these swings in perspective:

- I hear “headline 18%” and it’s “actually 6.9%” on my portfolio.

- That’s considering a very short investment time and starting to invest at the worst possible moment.

For comparison, let’s take another scenario of high uncertainty: March 2020, when fundamental questions on the viability of a global economy itself were being raised. Better stay out of investing then?

If I would have stayed out, I would have missed a gain of 6.3% today!

What does this all teach me?

It’s not about timing. I won’t ever be able to know where the stock market goes next year. So my strategy must eliminate timing & conditions from the equation. It’s about going in safely, buying with the same regular cadence, and staying in long.

Conclusion

Periods with consistently bad news where the broker account looks red all over the place can be demoralizing.

That’s what gets most new investors to end their investment journey – to a loss.

Yet those periods keep ending, just like they keep coming back. Overcoming them by persisting with a steady, prudent strategy is what makes you successful in the long run.

Don’t let a brief spike of doom distort your perception on a strategy assessed against 100+ years of history!

“Time in the market beats timing the market”. Keep the maxim at heart and go buy ice cream instead! 🍦

-

“Economics Explained” makes a good job explaining this in their episode “Are we stuck between Hyperinflation and a recession?” ↩︎

-

Source: “Estimating the structural rate of unemployment for the OECD countries”, by D. Turner et al, OECD Economic Studies No. 33, 2001/II. Get from OECD’s iLibrary or in article’s research package. ↩︎ ↩︎